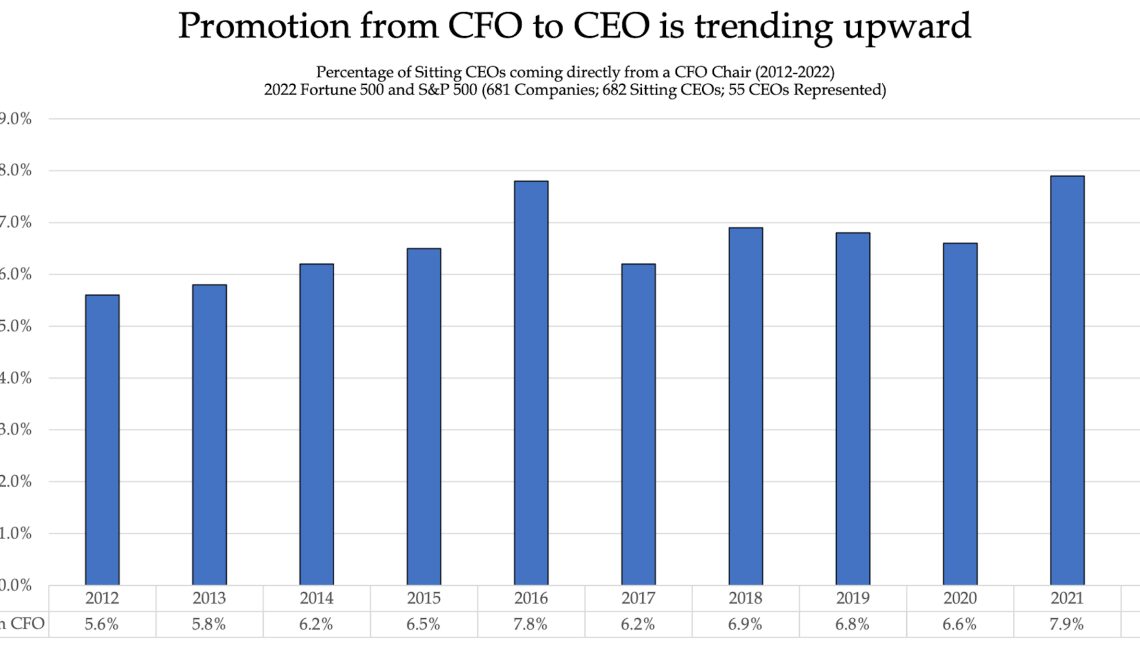

So far this year, we’ve been hearing of several CFOs moving into the CEO role at major companies. For example, Christina Spade, the CFO, and COO at AMC Networks was named the next CEO. And Donald Allan, Jr. was promoted from CFO to CEO at Stanley Black & Decker. In fact, the percentage of sitting CEOs coming directly from a CFO chair has reached an all-time high.

8.1% of CFOs at some of the largest companies in the U.S. were promoted to CEOs in the first half of 2022, according to executive search firm Crist Kolder Associates’ latest volatility report based on data from 681 companies in the Fortune 500 and S&P 500. In 2012, just 5.6% of finance chiefs were promoted to CEOs.

Courtesy of Crist Kolder Associates

I asked Clem Johnson, president of Crist Kolder Associates, whether companies looking to hire CFOs want candidates with CEO qualities. “It’s not a requirement, but a distinct, very positive differentiator,” Johnson told me.

“If a company is evaluating CFO candidates who have roughly equal finance competencies, the one that has some operational or commercial leadership experience can separate from the pack,” Johnson says. “They can be much more interesting as a candidate because they have demonstrated another dimension to their business acumen. It’s not just confined to the finance realm.”

Not surprisingly, the path from CFO to CEO is most common in the financial sector (25.5%). The path least common is the retail sector (3.6%), the report found. However, a commonality that the financial and retail sector share is having the longest tenured CFOs, which is an average of five years.

C-suite executives are not immune to the Great Resignation. And the past few years have been tumultuous for some companies. The report found that the industrial and services sectors accounted for over a third of all CFO turnover. For example, there are new CFOs at Intel Corporation (David Zinsner) and McDonald’s (Ian Borden)

The pandemic-induced supply chain crunch placed pressure on the industrial sector, and the services sector certainly took a hit from the lack of workers. “Some companies were feeling the heat, and had to poach from others to bring in new CFO leadership,” Johnson says.

The report found that since the beginning of the pandemic, there has been a significant dip in external hiring of CFOs. “In periods of heightened risk and turbulence, as we’re in now, where possible companies would prefer to…

Click Here to Read the Full Original Article at Fortune | FORTUNE…