[the_ad id="21475"]

[ad_1]

Over the past year, many Wall Street analysts have been forced to lower their price targets on a wide range of stocks. With macro headwinds caused by higher interest rates and recession fears working their way into expectations and the earnings of some firms, some analysts have even been pressured to lower their recommendations.

It’s hard to blame them with the list of uncertainties out there. With U.S. banks under pressure, there’s yet another thing for worrisome investors to hit the “sell” button over. Despite the bearish conditions and widespread downgrades, though, several analysts remain confident in a few high-quality names that have modest valuations and what it takes to persevere through the rest of this bear market.

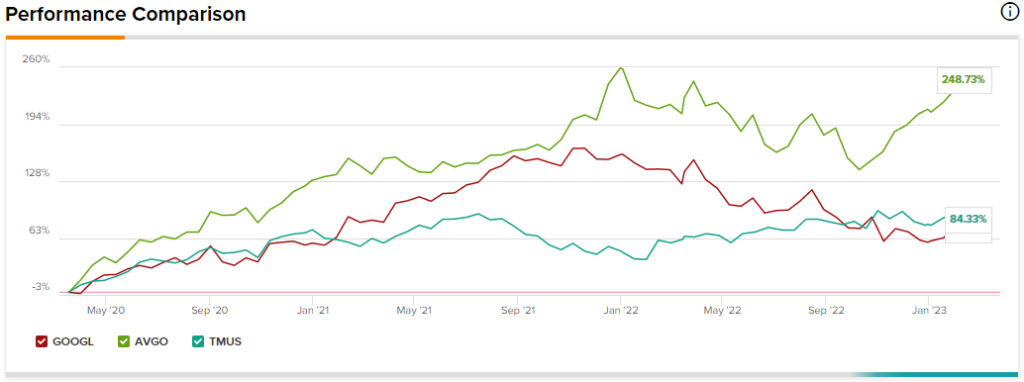

Therefore, in this piece, we’ll use TipRanks’ Comparison Tool to look at three stocks that still sport “Strong Buy” consensus ratings.

Alphabet is a search giant that some may fear is losing its edge amid the rise of generative artificial intelligence (AI). Indeed, OpenAI’s ChatGPT really does seem like a game-changer. With an upgraded version in GPT-4 on the way, Alphabet has the right to be worried as it feels the pressure in the early innings of the AI race. Nonetheless, I remain bullish.

AI is handy just about anywhere on the web. With Bing AI beckoning in Search users while other firms get aboard the GPT bandwagon, Alphabet has no time to waste if it’s to protect its economic moat around Search and AI.

Compared to other tech stocks that have rebounded furiously, Alphabet still seems to be stuck in a rut, likely because of concerns over AI. For instance, shares of Alphabet lost nearly 44% from peak to trough before bouncing back partially. Today, shares are still down around 34% from their 2021 peak.

Nonetheless, Alphabet has its own AI named Bard. Further, it can slap AI alongside its other software offerings. AI will play nicely with Search and Google’s Workspace applications. As OpenAI evens the playing field, though, the big question is whether loyal Google users have enough reason to switch.

Ultimately, the smarter and faster AI will determine who wins and who loses in the AI race, and right now, it’s not looking good for Google. However, at 21.4 times trailing earnings, the price of admission is modest to play an underdog with what it takes to take the lead at some point in the future, which is why I remain bullish.

What is the Price Target for GOOGL…

Click Here to Read the Full Original Article at TipRanks Financial Blog…

[ad_2]

[the_ad id="21476"]