[the_ad id="21475"]

[ad_1]

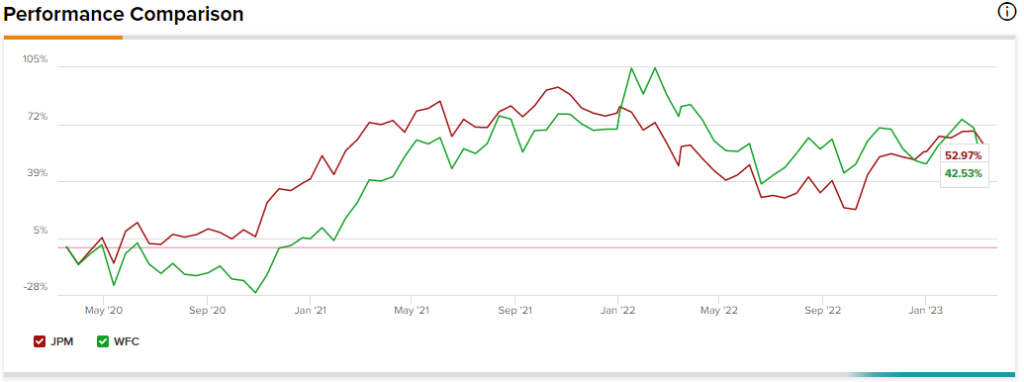

In this piece, I used TipRanks’ comparison tool to evaluate two big bank stocks, JPMorgan Chase (NYSE:JPM) and Wells Fargo (NYSE:WFC), to determine which is better. Although both firms are stalwart and considered “too big to fail,” meaning regulators probably won’t allow them to go under, the collapses of Silicon Valley Bank and Signature Bank did have small impacts.

JPMorgan stock is down 5.5% for the last five days, while Wells Fargo is down more than 8%. Thus, it makes sense to consider whether these sell-offs are sufficient enough to trigger a buy-the-dip opportunity.

JPMorgan Chase shares are down 10% for the last 12 months, so they’ve held up better than Wells Fargo stock, which is off 26% over the same timeframe. Nonetheless, both stocks are good, but a closer look suggests that WFC is the better stock. Let’s examine why.

JPMorgan Chase (NYSE:JPM)

While both firms are massive, JPMorgan Chase is significantly larger than Wells Fargo, raking in $128.6 billion in revenue for 2022 versus the latter’s $73.8 billion. However, a closer look at JPMorgan’s valuation multiples following the recent sell-off suggests a bullish view may be appropriate.

The firm is trading at a price-to-earnings (P/E) ratio of about 10.4x, which is significantly below the financials sector’s P/E ratio of 16.4x and its three-year average of 14x.

JPMorgan’s current P/E is also on the low side relative to its history, as its mean P/E since May 2018 is 12.2x. Turning to its price/book multiple, JPMorgan is currently at around 1.4x. Anything over 1.0 for a book value per share suggests a stock is overvalued, but a review of JPMorgan’s history shows that the firm always trades at a slight premium on book value.

At 1.4x, the firm’s book ratio is also fairly low relative to its history, as its mean since May 2018 stands at around 1.6x. Also, JPM’s price-to-sales (P/S) ratio of 3.1x is a bit higher than the industry median but is slightly below its historical average of 3.5x.

Finally, JPMorgan also offers a dividend yield of 3.1%, making it a solid dividend play.

What is the Price Target for JPM Stock?

JPMorgan Chase has a Moderate Buy consensus rating based on 11 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $156.87, the average JPMorgan Chase stock price target implies upside potential of 24.4%.

Wells Fargo (NYSE:WFC)

Wells Fargo has sold off a lot more than JPMorgan, but a…

Click Here to Read the Full Original Article at TipRanks Financial Blog…

[ad_2]

[the_ad id="21476"]