[the_ad id="21475"]

[ad_1]

On February 1, Meta Platforms (NASDAQ:META) CEO Mark Zuckerberg announced that 2023 will be a “year of efficiency” for the company where the tech giant focuses on becoming leaner, more productive, and even more profitable. Prior to this revelation, the company slashed its workforce by around 13% last November, laying off 11,000 employees. On March 14, Meta announced that another 10,000 employees will be laid off as the company prioritizes efficiency gains this year.

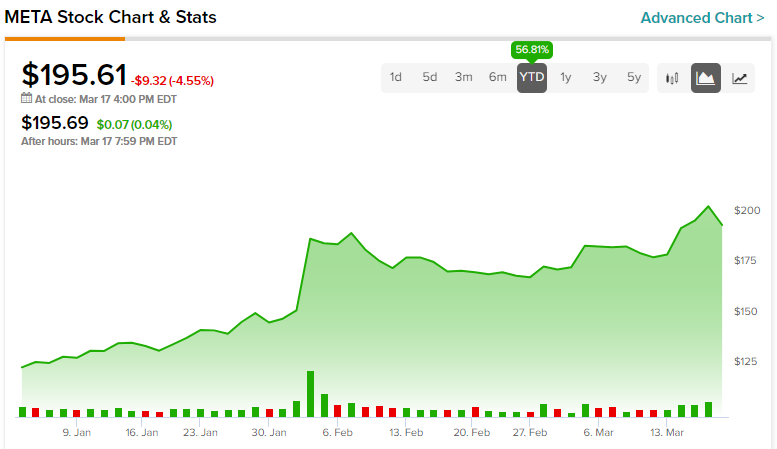

Although mass layoffs may not achieve the desired long-term results due to empirical data discussed below, I am bullish on Meta Platforms as the company remains undervalued despite a stellar year-to-date market performance.

Meta’s Vision for 2023

In an update to Meta’s Year of Efficiency strategy on March 14, CEO Mark Zuckerberg emphasized the company’s focus on improving its financial performance amid challenging macroeconomic conditions. In addition to layoffs, the company has decided to freeze hiring as well, and more than 5,000 openings that were advertised will not be filled. In a more organic move, Meta is also looking at ways to improve the efficiency of product developers.

Meta, as part of its strategy to boost efficiency, has pledged to focus less on low-priority projects. Ever since the company’s name change in 2021, many investors have been skeptical about its multi-billion-dollar investments in the metaverse division. With a renewed focus on high-priority business segments, the company’s metaverse investments are likely to dry down this year. Investors will welcome such a development as Meta lost more than $13 billion from its Reality Labs division last year, which focuses on VR, AR, and the metaverse.

Layoffs May Not be as Good as They Sound

The investor sentiment toward Meta has dramatically improved this year along with Meta CEO’s promise to focus on efficiency gains. Mass layoffs have boosted the market performance of many tech companies – not just Meta – as investors cheered the prospects for better-than-expected operating margins and profitability for 2023. Although it is imperative for a company to have a lean operating model to be successful in the long run, as investors, overestimating the positive impact of layoffs could be costly.

Several studies conducted on the long-term effectiveness of layoffs show that companies should approach layoffs with caution. One study, conducted by Korn/Ferry International and Wisconsin…

Click Here to Read the Full Original Article at TipRanks Financial Blog…

[ad_2]

[the_ad id="21476"]