[the_ad id="21475"]

[ad_1]

Just after mortgage rates spiked to 6%, Charlie Alvarez put his South Carolina home on the market in July 2022. He needed to sell for personal reasons. He was also worried that by listing after mortgage rates had spiked, he’d miss out on the frothy prices hit at the top of the Pandemic Housing Boom just months earlier.

“Originally, I thought we’d run into problems, I thought we’d sell for $350,000… But, we were on the market for less than a week, and had an offer,” Alvarez tells Fortune.

Alvarez ended up fetching his list price of $465,000 for his two-story craftsman-style home in Taylors, S.C. That’s 95% higher than the $238,500 he had paid for the four-bedroom home in 2015.

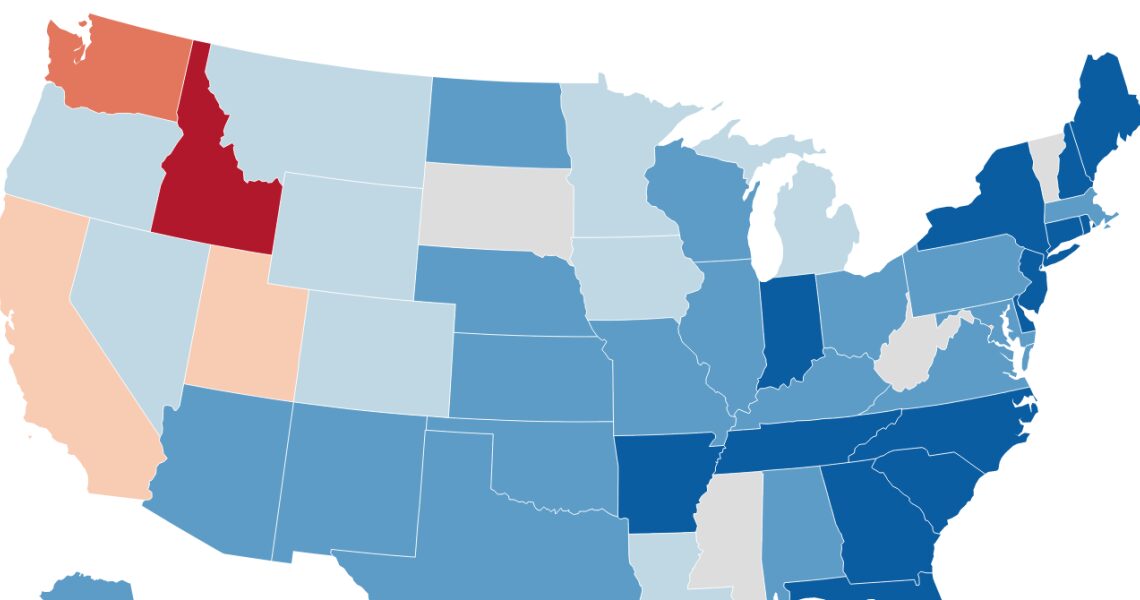

Even as the ongoing housing slump sees national home prices come down a bit from the peaks hit during the Pandemic Housing Boom, most homeowners are still up big-time. In fact, among the 46 states tracked by CoreLogic, 42 states saw average home equity levels rise between the fourth quarter of 2021 and the fourth quarter of 2022. Only California, Idaho, Utah, and Washington saw average equity levels fall between that year-over-year period.

“As U.S. home price growth continued its slow, steady decline in the final months of 2022, home equity trends naturally followed suit. In the fourth quarter of 2022, the average borrower earned about $14,300 in equity year-over-year, compared with the $63,100 gain seen in the first quarter of 2022,” wrote Selma Hepp, chief economist at CoreLogic, in a statement provided to Fortune.

The average homeowner in Florida saw the biggest gain, with average equity rising $49,032 between the fourth quarter of 2021 and the fourth quarter of 2022. Meanwhile, the average homeowner in Idaho saw the biggest decline, with average equity falling $21,352 during that period.

Through February, two-thirds of regional housing markets tracked by Zillow have seen local home prices fall from their 2022 peaks. However, only 39 of the country’s 400 largest major markets have seen local home prices fall by more than 5% on a seasonally adjusted basis. Almost all of those hard-hit markets are out West. (Here’s home price data for the nation’s 400 largest housing markets).

“While equity gains contracted in late 2022 due to home price declines in some regions, U.S. homeowners on average still have about $270,000 in equity more than they had at the onset of the pandemic,” writes Hepp. “Even in Idaho, where borrowers…

Click Here to Read the Full Original Article at Fortune | FORTUNE…

[ad_2]

[the_ad id="21476"]