[the_ad id="21475"]

[ad_1]

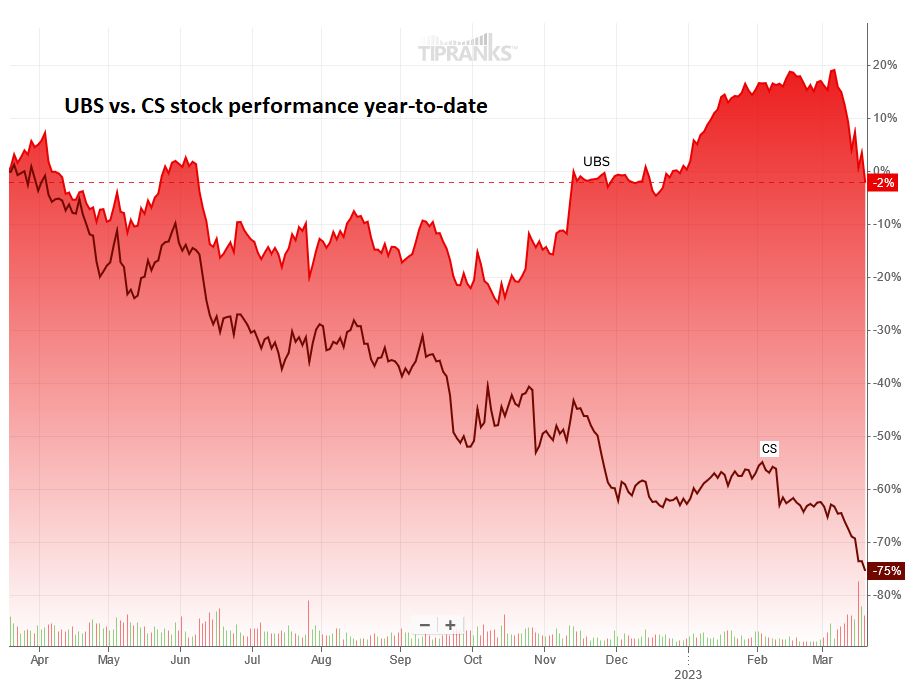

Last week, Europe’s banking stocks suffered their biggest drop in a year as Credit Suisse (NYCE:CS) shares tumbled so much that at some point markets feared it might collapse. After years of steady decline, marked by a series of scandals and mismanagement issues, CS was the natural victim of a market rout ignited by the failure of two niche U.S. banks. Push came to a shove after Credit Suisse’s main shareholder, Saudi National Bank, said it would not invest any more money in CS. The news spooked investors, who already felt uneasy about the lender, and pushed its shares down to a record low in the bank’s 167-year history.

Eventually, the Swiss central bank was forced to provide Credit Suisse with a $54 billion in a liquidity backstop to help revive investor confidence: although twice smaller than it was before the 2008 crisis, the bank is still too big to fail. However, the liquidity injection didn’t help quell markets anxiety about what was supposed to be safe, well, as a Swiss bank. CS stock continued to decline, stoking fears of a global banking crisis. JPMorgan (NYCE:JPM) assessed that CS’s loss of investor confidence prevents its future existence as an independent financial institution; outflows from the troubled lender reached over $10 billion a day, raising worries that the bank would become insolvent within a week.

During the weekend, Swiss officials have been scrambling to arrange for CS to be taken over by UBS (NYCE:UBS), Switzerland’s largest bank, in effort to restore confidence and stability. However, forced weddings aren’t bankers’ favorite pastime, and UBS seemed to be reluctant from the beginning to mar its relatively good record with CS’s indecent reputation, scarred with money-laundering convictions, fraud, holding accounts of criminals and dictators, corporate espionage fines, bad investment decisions and management churn. UBS is financially robust, especially compared to that of CS: it has $1.1 trillion in total assets, more than twice the assets of CS, and has reported a $7.6 billion net profit in 2022, while Credit Suisse posted a $7.9 billion net loss.

Besides, to save Credit Suisse from collapsing (and to save Europe’s already weakened banking system from imminent disaster that would follow such collapse), the deal would have to be closed in a number of days. This would work out perfectly for a small company or even a small bank, but it’s hard to see such a breakneck speed when the entity…

Click Here to Read the Full Original Article at TipRanks Financial Blog…

[ad_2]

[the_ad id="21476"]