[the_ad id="21475"]

[ad_1]

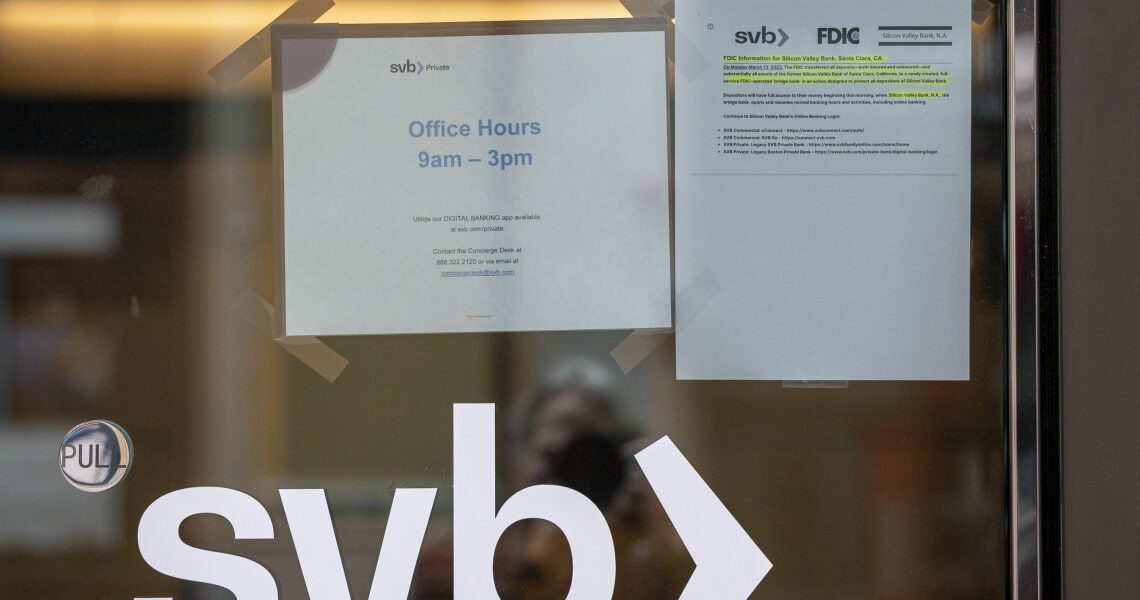

Where were you when you first heard Silicon Valley Bank was on the brink of collapse? If you’re in any type of financial leadership position, I’m sure you clearly remember.

When word started spreading on March 9 about a bank run at SVB, “a lot of treasurers and CFOs were saying, ‘Hey, what do I do if I’m exposed here, and is this going to be contagious?’” says Russ Porter, CFO of the Institute of Management Accountants (IMA). “One person even received a call and was warned to ‘get out of the banking system because it’s going to be catastrophic,’” Porter recalls. “But I don’t know any company today that can ‘get out of the banking system,’ unless you have a very large vault where you can stick large amounts of cash.”

But by March 13, “after we knew Fed was going to step in to backstop [SVB and Signature Bank], that’s when people got out of panic mode and started getting into, ‘What’s our risk?’” he explains. CFOs began facing difficult questions from stakeholders and boards, even if their company was not directly impacted, Porter says.

“I’m not just hearing that from financial professionals,” Porter says. “I had a scheduled meeting with committees of my board yesterday, and today, and they gently asked, ‘Can you comment on this and its impact on our organization?’” he explains. “‘What’s our exposure? And how do we manage our risk of overexposure to any of our business partners?’”

Porter continues, “Those kinds of conversations are happening in boardrooms around the country, and will be going on for the next couple of weeks.” A key question that most CFOs are going to be asked is: “We know you have a game plan, but how is it affected by this?” Porter says. Most CFOs should know what the risks are, but need to communicate it effectively to the board, he says.

Before becoming CFO at IMA, a professional organization of accountants, in 2021, Porter held several leadership roles as a 30-year member of IBM’s finance team. He named three takeaways for CFOs from SVB’s collapse:

– “You need to be proactive in thinking about and having game plans for the key risks of your organization,” Porter says. “And CFOs should be creative in making sure that they’re thinking about those risks from a number of different perspectives.”

– “Generally, overconcentration in one segment of the market or one segment of a business partner relationship…

Click Here to Read the Full Original Article at Fortune | FORTUNE…

[ad_2]

[the_ad id="21476"]