[the_ad id="21475"]

[ad_1]

The financial world continues to grapple with the fallout from last week’s stunning collapse of Silicon Valley Bank. However, SVB was more like a hedge fund than a bank. In fact, when the dust settles, SVB might turn out to be a glorified Ponzi scheme with poor risk management that relied on continued tech-driven growth and low interest rates to fuel its expansion.

If we compare the relative performance of Silicon Valley’s stock to that of JP Morgan and Bank of America since 1993, its market value rose 250-fold until the market’s peak on Nov 3, 2021, relative to 11-fold for JP Morgan and three-fold for Bank of America. Which raises the obvious question: Since banks borrow and lend at roughly the same rates, how could a bank possibly outperform an industry leader by a factor of 20? The post-mortem should offer some important lessons for regulators on the creative ways in which businesses can disguise themselves and deflect scrutiny.

But there’s a larger lesson here for investors: that it pays to take risks when the herd is panicking. On the day of SVB’s failure, a student from my systematic investing class at NYU Stern messaged me that our recent session on “overreactions” actually described the current state of financial markets very well.

My course, which is based on my experience operating a machine-learning-based hedge fund on Wall Street, describes how to exploit mispricing opportunities systematically using algorithms. A challenge, for example, is how to recognize overreactions. An algorithm can do that. In our class assignment, we used a simple volatility-based formula to categorize overreactions and to implement a simple counter-trend system.

To make things interesting, my student sent me results from applying the strategy to JP Morgan since 1993. Her implementation of the assignment showed impressive risk-adjusted performance for JP Morgan and Bank of America, relative to just holding them. The lesson here is that market turmoil often causes mispricing in areas of the market that may be quite far removed from the source of the turmoil, which presents opportunities for savvy investors.

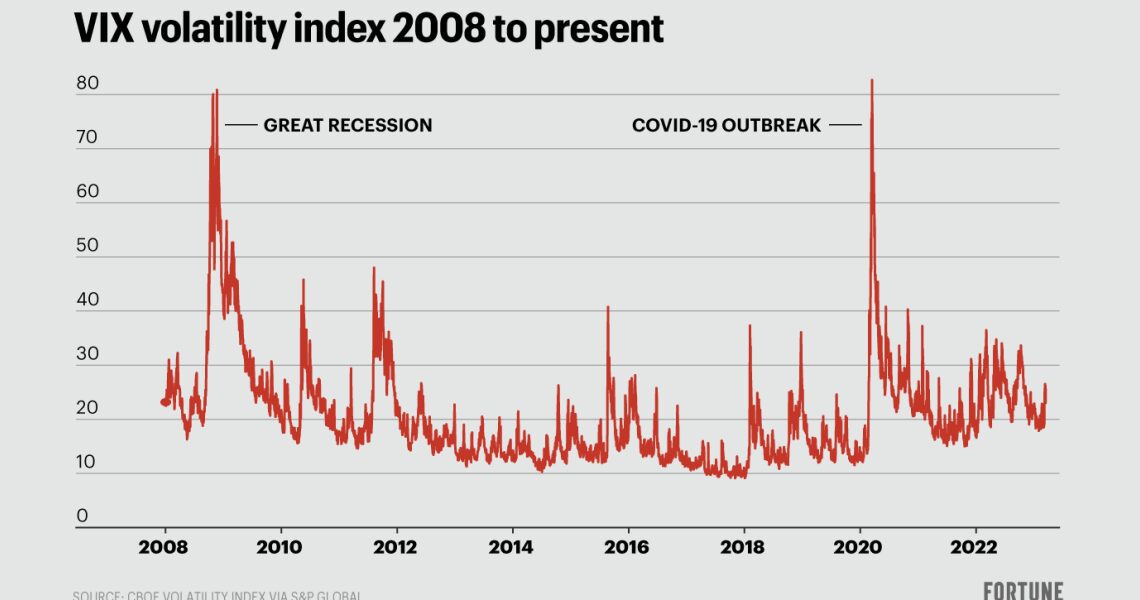

The larger takeaway is that even a simple reversion algorithm like the one above that I used for my class assignment can work across the market because investors often over-react. But it suffers in situations like the Great Financial Crisis when extreme price moves keep going in the same direction until the market finds a new…

Click Here to Read the Full Original Article at Fortune | FORTUNE…

[ad_2]

[the_ad id="21476"]