[the_ad id="21475"]

[ad_1]

Cathie Wood‘s popular ARK Innovation ETF (NYSEARCA:ARKK) is off to a hot start in 2023, with a 21% gain year-to-date. However, based on recent events concerning some of its top holdings, ARKK could be under some pressure in the near term and cool down after this scintillating start.

While ARKK itself finished only 1.5% lower today, two of its top holdings, Block (NYSE:SQ) and Coinbase Global (NASDAQ:COIN), were under considerable pressure based on negative news that came out about them.

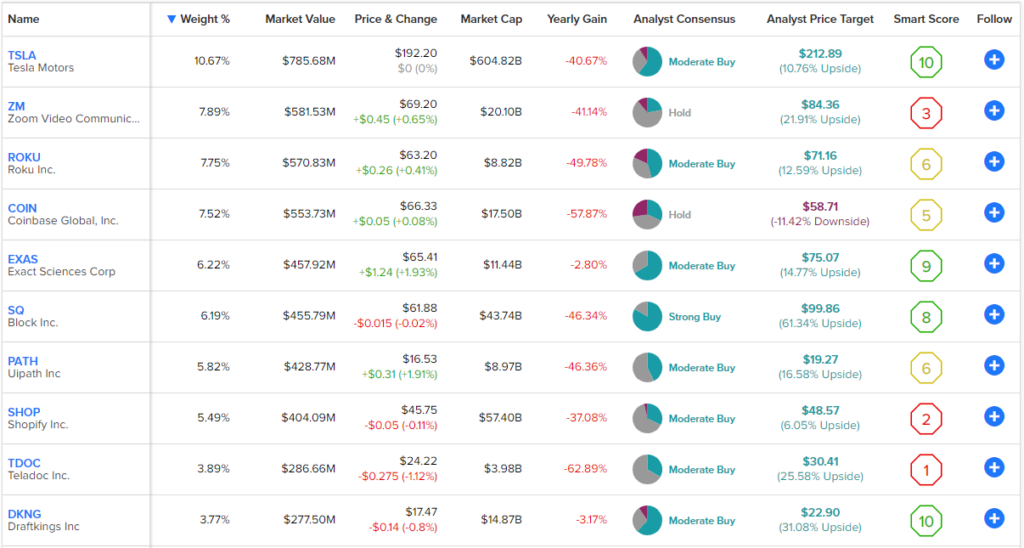

See below for an overview of ARKK’s top holdings using TipRanks’ Holdings screen, which gives investors a holistic overview of an ETF’s components. As you can see, Coinbase is ARKK’s fourth-largest position, accounting for 7.5% of funds, and Block is the sixth-largest holding, accounting for 6.2%.

What’s Going on with Coinbase?

Coinbase received a Wells notice from the SEC (essentially a warning that the SEC will recommend enforcement action against a company for violating securities laws), and the stock finished 14.1% lower today, while it was down nearly 20% at one point. The warning is likely related to Coinbase’s EARN product (which allows customers to stake their crypto and receive rewards on it) or possibly products like Coinbase Prime and Coinbase Wallet.

The unwelcome development caused a number of sell-side analysts to take note. Oppenheimer downgraded Coinbase from Outperform to Perform, while Jefferies says that the potential enforcement action could jeopardize as much as 35% of Coinbase’s revenue, which would be a significant blow to the stock.

What is the Price Target for COIN Stock?

The analyst community, in general, is cautious about Coinbase, especially after its recent run. Even after today’s sell-off, Coinbase is still up 87.3% year-to-date. However, the consensus on Coinbase is that the stock is a Hold, and the average COIN stock price target of $59.88 implies downside potential of 9.7%. Of the 22 analysts covering the stock, seven maintain a Buy rating, nine have a Hold rating, and six analysts say Coinbase is a Sell.

What Happened to Block Stock?

Meanwhile, Block had the ignoble distinction of being the latest company to find itself as the subject of a short-seller report from Hindenburg Research. Hindenburg has grown in stature with well-timed and high-profile short calls on stocks like Nikola Motors (NASDAQ:NKLA), Lordstown Motors (NASDAQ:RIDE), and India’s Adani…

Click Here to Read the Full Original Article at TipRanks Financial Blog…

[ad_2]

[the_ad id="21476"]