[the_ad id="21475"]

[ad_1]

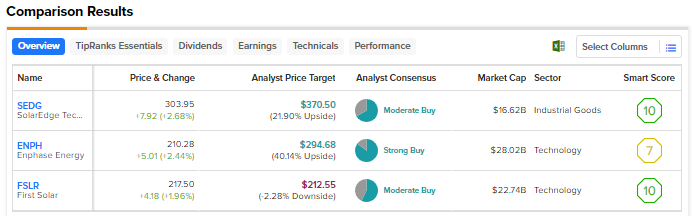

Governments across the world are focusing on the transition from fossil fuels to renewable sources of energy. This week, the European Union reached a preliminary deal to source 42.5% of its energy consumption from renewables by 2030, up from the previous target of 32%. Solar companies are expected to gain tremendously from the growing demand for clean energy in the U.S., Europe, and elsewhere. With that thought in mind, we used TipRanks’ Stock Comparison Tool, to place SolarEdge (NASDAQ:SEDG), Enphase Energy (NASDAQ:ENPH), and First Solar (NASDAQ:FSLR) against each other to pick the best solar stock.

SolarEdge Technologies (NASDAQ:SEDG)

SolarEdge and Enphase are dominant players in the U.S. residential solar inverter market. Last month, SolarEdge reported upbeat fourth-quarter results. The company’s adjusted EPS jumped to $2.86 from $1.10 in the prior-year quarter, driven by a 61% rise in revenue to $891 million and enhanced margins.

Following the results, JPMorgan analyst Mark Strouse increased the price target for SEDG to $361 from $358, calling it “one of the few solar stocks that is consistently profitable, generates cash and has a solid balance sheet.” Strouse expects the weakness in the U.S. residential solar market to be offset by the shipments to Europe, which could limit the downside risk.

Meanwhile, KeyBanc analyst Sophie Karp recently initiated coverage on SolarEdge with a Hold rating. The analyst highlighted that the company has a “duopolistic position” in the U.S. with nearly 50% market share, which helps in generating steady margins and growth rates.

Karp also noted SolarEdge’s diversification and greater international presence compared to rivals, which gives greater growth stability “at the expense of somewhat lower gross margin due to a more price competitive environment outside of the U.S.” However, the analyst is sidelined on the stock as she believes that it is almost fairly valued.

Is SolarEdge a Good Stock to Buy?

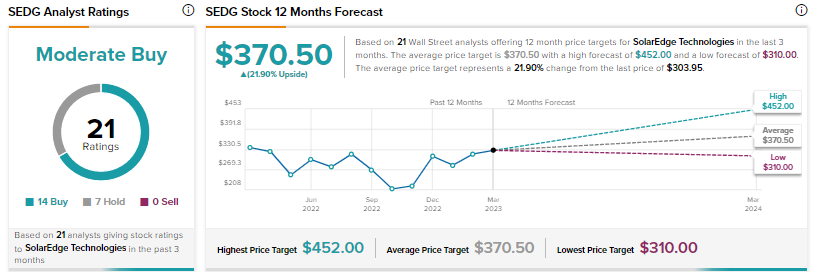

Overall, SolarEdge scores a Moderate Buy consensus rating based on 14 Buys and seven Holds. At $370.50, the average SEDG stock price target implies nearly 22% upside potential. Shares have risen over 7% year-to-date.

Enphase Energy (NASDAQ:ENPH)

Enphase, a leading supplier of microinverter-based solar and battery systems, experienced solid demand for its energy systems in the fourth quarter of 2022. Revenue increased almost 76% to $724.7 million and adjusted…

Click Here to Read the Full Original Article at TipRanks Financial Blog…

[ad_2]

[the_ad id="21476"]