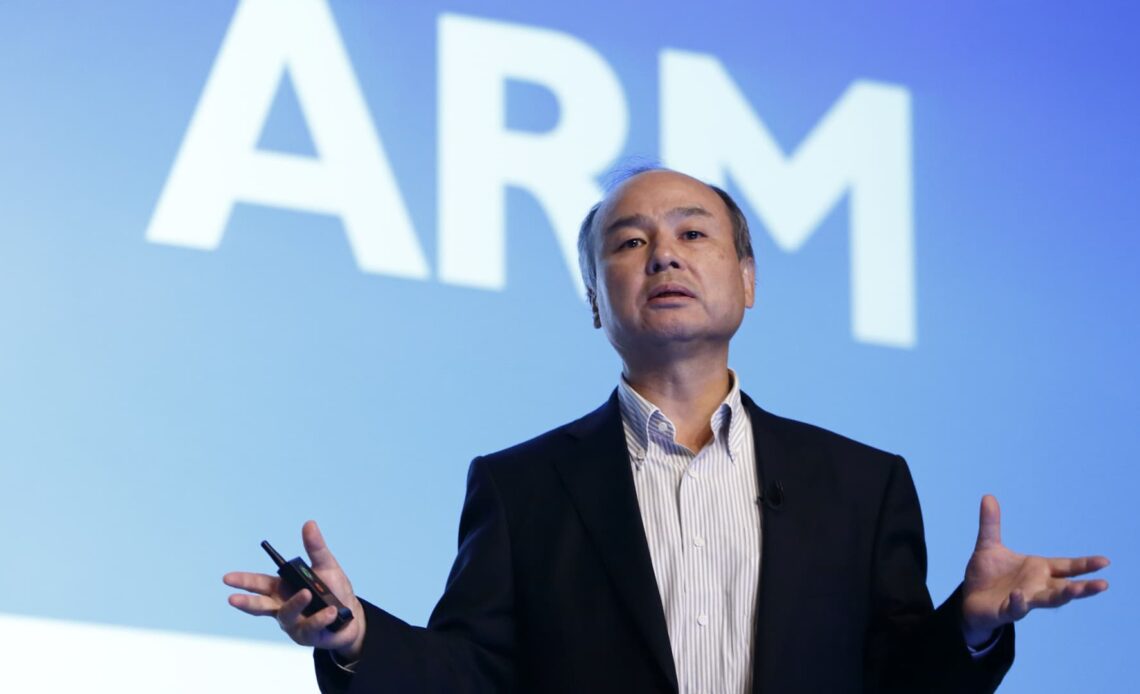

Billionaire Masayoshi Son, chairman and chief executive officer of SoftBank Group Corp., speaks in front of a screen displaying the ARM Holdings logo during a news conference in Tokyo on July 28, 2016.

Tomohiro Ohsumi | Bloomberg | Getty Images

The U.K. may be a great place to build a tech company — but when it comes to taking the crucial step of floating your business, the picture isn’t so rosy.

That’s the lesson several high-growth tech businesses have come to learn in London.

When Deliveroo went public in 2021, at the height of a pandemic-driven boom in food delivery, the company’s stock quickly tanked 30%.

Investors largely blamed the legally uncertain nature of Deliveroo’s business — the company relies on couriers on gig contracts to deliver meals and groceries to customers. That has been the subject of concern as these workers look to gain recognition as staffers with a minimum wage and other benefits.

But to many tech investors, there was another, much more systemic, reason at play — and it’s been cited as a factor behind chip design giant Arm’s decision to shun a listing in the U.K. in favor of a market debut in the U.S.

The institutional investors that dominate the London market lack a good understanding of tech, according to several venture capitalists.

“It’s not the exchange, it’s the people who trade on the exchange,” Hussein Kanji, founding partner at London VC firm Hoxton Ventures, told CNBC. “I think they’re looking for dividend-yielding stocks, not looking for high-growth stocks.”

“Two years ago, you could have said, you know what, it might be different, or just take a chance. Now a bunch of people have taken a chance and the answers have come back. It’s not the right decision.”

Numerous tech firms listed on the London Stock Exchange in 2021, in moves that buoyed investor hopes for more major tech names to start appearing in the blue-chip FTSE 100 benchmark.

However, firms that have taken this route have seen their shares punished as a result. Since Deliveroo’s March 2021 IPO, the firm’s stock has plummeted dramatically, slumping over 70% from the £3.90 it priced its shares at.

Wise, the U.K. money transfer business, has fallen more than 40% since its 2021 direct listing.

There have been some outliers, such as cybersecurity firm Darktrace, whose stock has climbed nearly 16% from its listing price.

However, the broad consensus is that London is failing to attract some of the massive tech companies that have become household names on major…

Click Here to Read the Full Original Article at Top News and Analysis (pro)…