[the_ad id="21475"]

[ad_1]

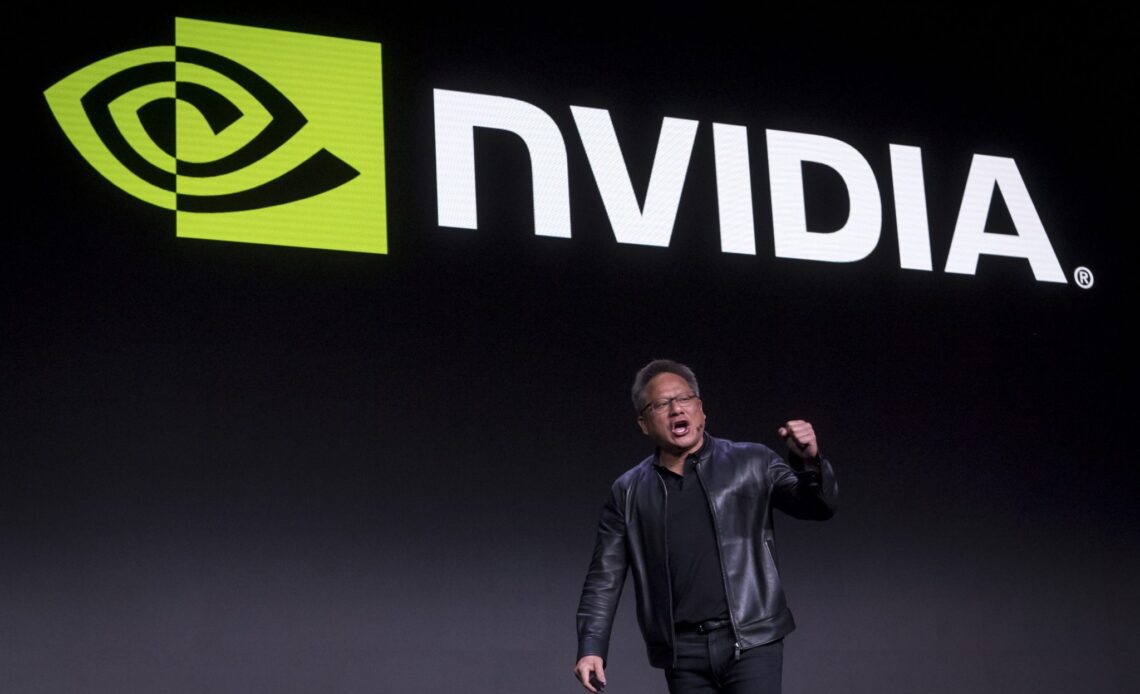

Nvidia stock soared nearly 25% Thursday after the company announced standout earnings and predicted its sales would rise to $11 billion for the three months ending in July. Wall Street forecasters had estimated sales were going to be roughly $7.2 billion for that period.

Bank of America analysts, led by Vivek Arya, said the semiconductor giant’s guidance amounts to “the largest raise” they’ve ever seen from a company and is clearly “driven by the start of major data center investments in generative AI and large language models.” The analysts lauded Nvidia’s graphics processors that are used in data centers to help power artificial intelligence applications as a long-term cash cow for the company.

Investors have been riding a wave of A.I. euphoria ever since OpenAI released its A.I. chatbot ChatGPT in November and managed to pull in 100 million users faster than any app in history. And while some on Wall Street have started to question the staying power of the recent A.I. boom, Nvidia’s stellar earnings helped legitimize the hype in the minds of many analysts this week.

Bank of America’s team raised its price target for Nvidia from $340 to $450 in a Thursday post-earning note, arguing the company has established itself as an “A.I. leader” and the market cap is set to soar to “$1 trillion and beyond.” The $450 price target represents a potential 17% price increase from Thursday’s closing price of just over $379 per share.

Bank of America’s Vivek Arya has held Nvidia as a “top pick” for investors since June of last year, when he argued that semiconductor stocks were oversold by recession-wary investors. And in a research note earlier this month, Arya gave a $340 12-month price target for Nvidia stock, saying he believed the company’s semiconductors make it the “picks and shovels leader in the A.I. gold rush.”

It hasn’t always been smooth sailing for Nvidia, however. Shares of the chipmaker sank almost 70% between its previous all-time high in November 2021 and its October 2022 trough, as rising interest rates and recession fears weighed on tech and growth stocks. But since then, the A.I. boom has boosted Nvidia shares over 230%. And the latest earnings only confirmed for many investors and analysts that the stock will continue to rise. Nvidia is “uniquely positioned to help transform the nearly $1 trillion of traditional data centers towards accelerated/AI driven computing,” according to Bank of…

Click Here to Read the Full Original Article at Fortune | FORTUNE…

[ad_2]

[the_ad id="21476"]