[the_ad id="21475"]

[ad_1]

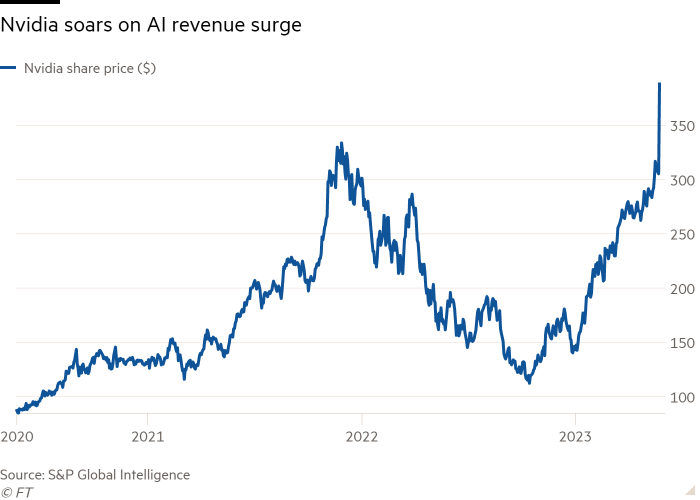

Nvidia’s blowout sales forecast has set the Silicon Valley company on course to become the first chipmaker to be valued at more than $1tn, as booming demand for its artificial intelligence processors drove semiconductor stocks higher on Thursday.

Shares in Nvidia rose 24 per cent after its $11bn sales forecast for the three months ending in July came in more than 50 per cent ahead of Wall Street’s previous estimates.

Nvidia added $184bn to its market capitalisation following Wednesday’s quarterly report, more than the entire value of Intel or Qualcomm and the biggest one-day gain ever for a US stock, according to figures from Bloomberg. With a market capitalisation of $939bn, Nvidia appears within reach of joining Apple, Microsoft, Alphabet, Amazon and Saudi Aramco in the elite group of companies valued at more than $1tn.

Alongside Nvidia, chip suppliers including Taiwanese manufacturer TSMC and Dutch equipment maker ASML reported big gains, up 3 per cent and nearly 5 per cent, respectively.

Wednesday’s results bolstered Nvidia’s claim to be the only company whose tech is capable of meeting demand from across the industry to build generative AI, systems capable of creating humanlike content. The group pointed to “exponential growth” in demand for computing power from cloud and internet companies as well as the automotive, financial services, healthcare and telecoms industries.

Products including Nvidia’s most powerful H100 processor have become much sought after, not only by Big Tech companies but also a new wave of AI start-ups, such as OpenAI and Anthropic, which have raised billions of dollars in venture funding over recent months.

“We are obviously seeing a huge spike in AI demand and Nvidia is at the very front line of that,” said Geoff Blaber, chief executive of CCS Insight, a tech consultancy, describing its chips and allied software tools as the “picks and shovels” of a “generational shift in AI”. “They are without doubt in pole position because they provide a very comprehensive toolchain that no other company is able to currently.”

AMD, which like Nvidia makes the specialised chips best suited to training vast sets of data for AI, jumped 11 per cent, while Micron, the American memory chip supplier that faces new trade restrictions in China amid escalating tensions with the US, climbed 4.6 per cent. Shares in Microsoft and Google were up too.

Click Here to Read the Full Original Article at UK homepage…

[ad_2]

[the_ad id="21476"]