[the_ad id="21475"]

[ad_1]

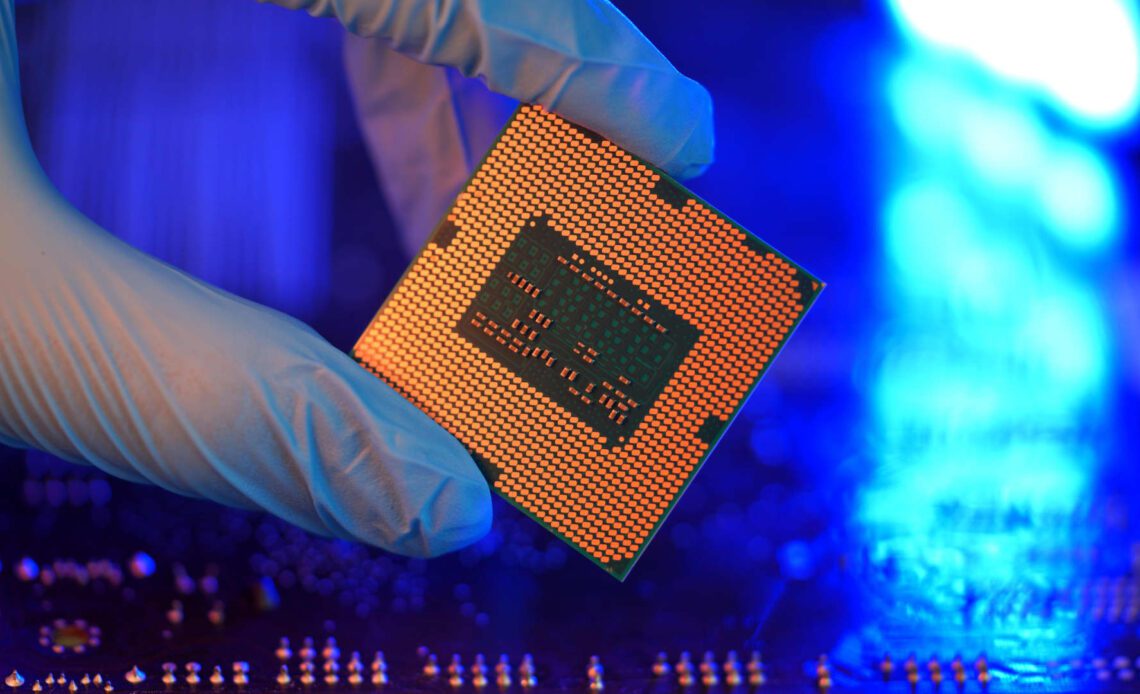

Surging demand for artificial intelligence helped Nvidia blow past Wall Street’s expectations on Wednesday. But while the chipmaker remains the undisputed leader in the AI arms race, it’s far from the only company benefitting from the frenzy overtaking Wall Street. The stock soared more than 29% before the bell on Thursday, building on its already huge returns this year after it shared a jaw-dropping forecast that blew past Wall Street’s estimates as demand for AI chips booms. Nvidia also topped earnings expectations on the top and bottom lines. NVDA 1D mountain Nvidia shares pop While Nvidia’s results seem to reiterate its clear chip dominance, other names are gaining buzz on Wall Street and could see big gains as AI booms. Advanced Micro Devices Like Nvidia, Wall Street forecasts opportunities for Advanced Micro Devices in the near future. Shares of the chipmaker surged 10% before the bell on the heels of Nvidia’s blockbuster report. Like its competitor, AMD creates graphics processing units underpinning most generative AI tools. Even big investors have amped up their bets on this AI play in recent weeks, with securities filings released earlier this month showing that Dan Loeb’s Third Point took a sizeable stake in the company during the first quarter. In a March note to clients, Raymond James called AMD the “underappreciated play on AI/ML,” saying that it expects continued share gains from the company through yearend. Taiwan Semiconductor Taiwan Semiconductor Manufacturing could also gain big as it rides on the coattails of Nvidia. Bank of America analyst Brad Lin highlighted the chip supplier as a “key beneficiary” in a Thursday note to clients, adding that shares also look attractive and toward the low-end of their historical range. Lin projects that Nvidia alone accounts for about 10% of the company’s revenues. TSM YTD mountain Shares in 2023 Like Bank of America, Needham highlighted the stock’s cheap valuation, saying that the market is failing to give the stock the “credit it deserves” for its “unique” AI position. “TSMC’s pole position in semiconductor fabrication makes the company the only practical foundry, in our opinion, to manufacture the most advanced chips such as AI accelerators,” the firm wrote. Needham also believes that Taiwan Semiconductor’s capabilities offer a “shortcut” for companies big and small looking to get into the competitive AI chip market. Shares gained about 7% before the bell, building on its 21% jump this year….

Click Here to Read the Full Original Article at Investing…

[ad_2]

[the_ad id="21476"]