[the_ad id="21475"]

[ad_1]

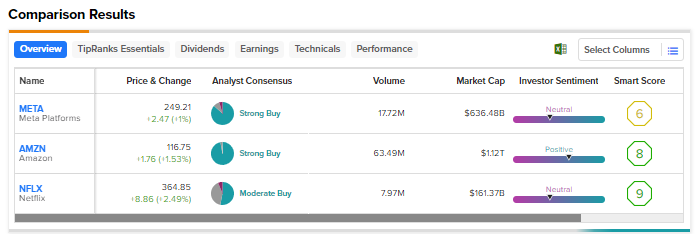

FAANG stocks [Meta Platforms (NASDAQ:META), previously called Facebook, Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), and Google’s parent company Alphabet (NASDAQ:GOOGL, GOOG)] have fared better than the S&P 500 (SPX) so far this year, with META shares generating impressive returns. However, macro pressures continue to impact these five tech players. We used TipRanks’ Stock Comparison Tool to place Meta, Amazon, and Netflix against each other to pick Wall Street’s favorite FAANG stock at current levels.

Meta Platforms (NASDAQ:META)

Shares of social media giant Meta Platforms have rallied by a phenomenal 107% year-to-date. The company impressed investors by returning back to revenue growth in the first quarter (after three straight quarters of decline) despite subdued digital ad spending due to macro pressures.

Investors have also cheered the company’s aggressive cost-cutting and streamlining efforts, including thousands of layoffs. Despite the distraction caused by regulatory matters, most Wall Street analysts remain optimistic about Meta’s prospects.

Meta’s user base continues to expand, with daily active people (number of users who visited at least one of the family apps –Facebook, Instagram, Messenger, and WhatsApp in a day) growing 5% year-over-year to 3.02 billion in March. The company expects capital expenditure of $30 billion to $33 billion this year toward the build-out of its artificial intelligence (AI) capacity to support ads, Feed, and Reels as well as increased investment in generative AI initiatives.

Is Meta a Good Stock to Buy?

On Tuesday, Piper Sandler analyst Thomas Champion reiterated a Buy rating on Meta Platforms stock with a price target of $270 price target after taking a deep look at the company’s AI capabilities.

The analyst sees the company leveraging AI to boost user engagement, develop better and more automated advertiser tools, and create an open-source AI ecosystem. Champion is also optimistic about Meta’s positioning within the digital ads space.

For Champion, Meta remains his top pick in digital advertising. He expects the company’s AI initiatives to drive revenue share gains in 2023 and 2024, recapturing the market share lost following Apple’s (AAPL) iOS privacy policy changes.

Wall Street’s Strong Buy consensus rating for Meta is based on 39 Buys, five Holds, and two Sells. The average price target of $281.05 implies an upside of nearly…

Click Here to Read the Full Original Article at TipRanks Financial Blog…

[ad_2]

[the_ad id="21476"]