[the_ad id="21475"]

[ad_1]

More large US companies are taking shelter in bankruptcy court, a sign of a tightening credit squeeze as interest rates rise and financial markets become less hospitable to borrowers.

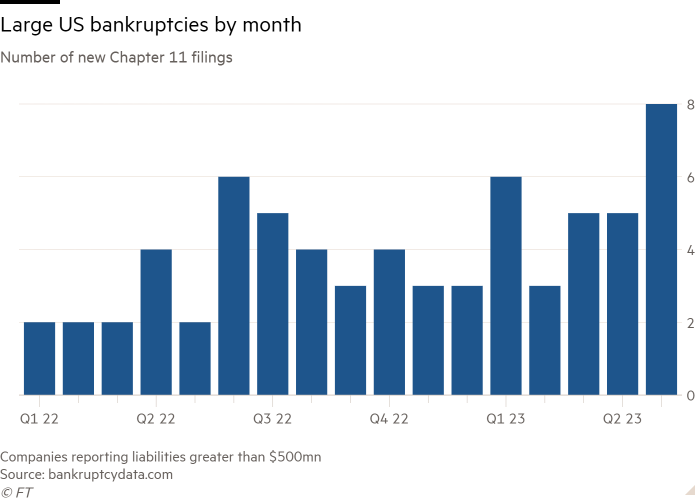

Eight companies with more than $500mn in liabilities have filed for Chapter 11 bankruptcy this month, including five in a single 24-hour stretch last week. In 2022 the monthly average was just over three filings.

Twenty-seven large debtors have filed for bankruptcy so far in 2023 compared to 40 for all of 2022, according to figures compiled by bankruptcydata.com. Among recent companies to succumb to creditors include Envision Healthcare, Vice Media and Kidde-Fenwal, a maker of fire control systems facing thousands of lawsuits over its use of so-called forever chemicals.

The bankruptcies come after years of quiescent markets and rising valuations allowed even financially stressed firms to raise debt and equity capital to stay afloat. Debt default rates had fallen to about 1 per cent in 2021 as central banks pumped money into the coronavirus pandemic-stressed economy.

Now, S&P Global forecasts that the 12-month trailing default rate for speculative-grade securities will jump from the current 2.5 per cent to 4.5 per cent by early 2024.

Yields on junk bonds have more than doubled from less than 4 per cent in mid-2021, as measured by the BofA US High Yield Index, an indication of how much more expensive capital has become for less creditworthy borrowers. The Federal Reserve has warned that lenders could further contract the supply of credit to businesses after recent turmoil in the banking sector.

“Our general view is that we are going to see an increase in ‘hard restructurings’, driven by the combination of higher debt levels from the borrowing binge of Covid and rising interest rates. The triggers will be running out money and inability to refinance maturing debt,” said Bill Derrough, an investment banker at Moelis who advises clients across distressed situations.

“Some companies have used every trick in the book and now have run out of tricks.”

Between 2020 and 2022, several private equity-backed companies pursued “liability management” transactions to survive, raising cash through new borrowings and extending maturities.

Such deals have been controversial as they pushed down the claims of large groups of creditors in the event of bankruptcy. Two companies that pursued high-profile liability management transactions, Envision Healthcare and Serta…

Click Here to Read the Full Original Article at UK homepage…

[ad_2]

[the_ad id="21476"]