[the_ad id="21475"]

[ad_1]

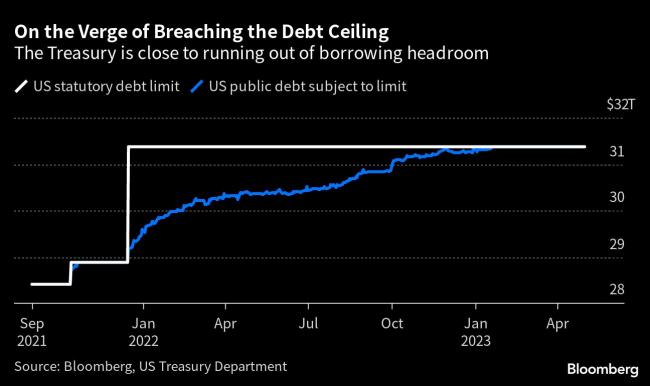

(Bloomberg) — Investor concerns around the US debt ceiling ebbed further on Wednesday as the deal struck by President Joe Biden and Speaker Kevin McCarthy headed toward a vote in the House of Representatives after clearing a crucial procedural hurdle with days remaining to avoid a calamitous default.

The cost of insuring US sovereign debt against default via derivatives has tumbled. At one point this month it exceeded levels on the bonds of many emerging markets with credit ratings well below that of the world’s biggest economy. Yields on Treasury bills maturing in early June — when Treasury Secretary Janet Yellen has said her department risks running out of cash — also extended their decline for the most part amid optimism around the agreement to avoid breaching the $31.4 trillion debt limit. Bills due June 6 yielded 5.17%, down from more than 7% at one point last week.

Meanwhile, the amount of money the US government has to pay its bills rebounded slightly at the end of last week, according to data released Tuesday. The Treasury’s cash pile, which had dwindled to the lowest level since 2017, climbed on Friday, giving the administration a little more breathing room under the statutory debt limit. But until the debt-cap accord is fully implemented, the Treasury is maneuvering on the assumption that the government could still exhaust its borrowing authority.

Congress is racing to approve the measure before June 5, the date Yellen has warned the US risks default. While leaders in both parties face members who oppose concessions made by negotiators in the compromise unveiled over the weekend, although there are signs of growing momentum behind the legislation.

From Washington to Wall Street, here’s what to watch to gauge how sentiment is shifting.

The Bills Curve

Investors have historically demanded higher yields on securities that are due to be repaid shortly after the US is seen as running out of borrowing capacity. That puts a lot of focus on the yield curve for bills — the shortest-dated Treasuries. Noticeable upward distortions in particular parts of the curve tend to suggest increased concern among investors that that’s the time the US might be at risk of default. That had been most prominent around early June, but yields on those maturities have eased since the Biden-McCarthy deal was announced, suggesting investors are less concerned about the threat of missed payments. While Treasury’s bill auction…

Click Here to Read the Full Original Article at All News…

[ad_2]

[the_ad id="21476"]