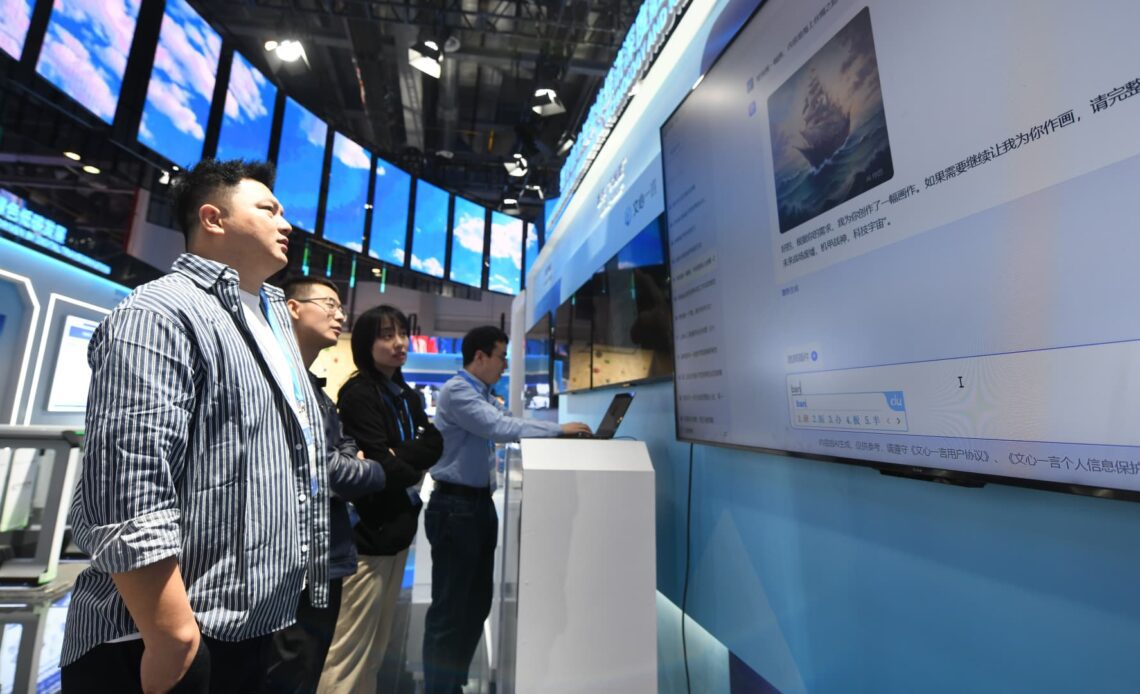

People learn about Baidu’s artificial intelligence chatbot service Ernie Bot during the 2nd Global Digital Trade Expo at Hangzhou International Expo Center on November 23, 2023 in Hangzhou, Zhejiang Province of China.

China News Service | China News Service | Getty Images

Nvidia’s rocket-ship ride in the stock market underscores the extent to which chip quality and availability will dictate the winners in the generative AI era. But there’s another aspect to measuring early leads in the space. In China, which is angling to produce its own chips or get more from Nvidia, no dominant gen AI contender to OpenAI has emerged yet among dozens of Chinese tech titans and startups.

Late to the game, China is seeking to catch the lead of OpenAI in a wider U.S. AI market shaped by tech titans Microsoft, Alphabet’s Google and Amazon, and well-financed startups including Anthropic, which this week received a $2.7 billion infusion of cash from Amazon.

In the fast-moving field, the gap between the U.S. and its tech rival China is seen as wide. “The leading Chinese companies are benchmarking against ChatGPT, which indicates how far behind they are,” said Paul Triolo, senior vice president for China and technology policy lead at Dentons Global Advisors in Washington, D.C.

“Not too many companies can support their own large language model. It takes a lot of capital. Silicon Valley is definitely well ahead of the game,” said Jenny Xiao, a partner at AI VC firm Leonis Capital in San Francisco.

The U.S. remains the biggest investment market. Last year, funding of gen AI upstarts accounted for nearly half of $42.5 billion invested globally in artificial intelligence companies, according to CB Insights. In the U.S., VCs and corporate investors drove AI investment to $31 billion across 1,151 deals, led by large outlays in OpenAI, Anthropic and Inflection. This compares with $2 billion in 68 deals in China, which marked a large drop from 2022’s $5.5 billion in 377 deals. The fall-off is partly attributable to restrictions on of U.S. venture investment into China.

“China is at a big disadvantage in building the foundation models for Gen AI,” said Rui Ma, an AI investor and co-founder of investment syndicate and podcast TechBuzz China.

But where China lags in foundational models, which are dominated by OpenAI and Google’s Gemini, it’s closing the gap by using Meta’s open source, large language model Llama 1, and Triolo said the Chinese contenders, if behind, are improving on…

Click Here to Read the Full Original Article at Top News and Analysis (pro)…