Big Tech staffers may be swapping out their beloved Patagonia vests for sunglasses and shorts as the sector continues to migrate to warmer climes.

Traditionally,, America’s enterprise hubs have centered around New York and Silicon Valley.

But over the past decade, and particularly since the pandemic, Miami has pushed itself up the rankings to become a powerhouse in its own right.

The Sunshine State is now home to some of the nation’s highest-profile brands across various industries.

In finance, Ken Griffin’s Citadel and Citadel Securities have made Miami their permanent headquarters, while JPMorgan Chase CEO Jamie Dimon used his annual shareholder letter to highlight the renovation of the company’s Tampa offices and the $210 million it will add to the local economy.

The likes of Microsoft, Amazon, and now Apple are also reportedly increasing their presence in the area.

The post-pandemic shift of Big Tech companies moving to South Florida began with Microsoft, which announced in 2021 it was moving its Latin America regional team to Miami’s seafront Brickell district.

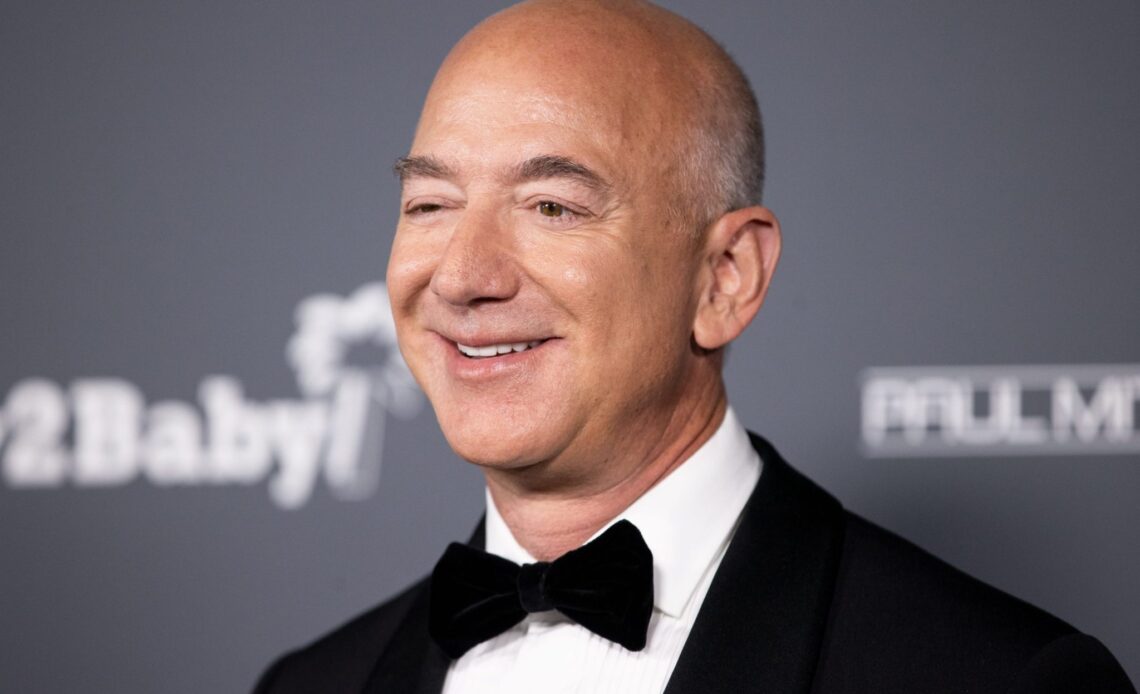

A couple of years later, Amazon announced its hunt for a further 50,000 square feet in the area, following its founder, Jeff Bezos, from Seattle.

Bezos announced in November 2023 that he was leaving his longtime home city of Seattle for the ‘billionaire’s bunker‘ of South Florida’s Indian Creek Island, where he now owns three mansions.

More recently, it was reported that Apple was joining the tech exodus to Florida, taking 45,000 square feet (4,181 square meters) in a new building in Coral Gables, a wealthy suburb just south of Miami.

Apple did not respond to Fortune’s request for comment.

VC money

New York and San Francisco have long been considered the frontrunners in fostering enterprise, and VC data supports that.

Between 2019 and 2021, 27.8% of venture capital investments went into the metro districts of San Francisco, Oakland, and Fremont (one of the cities in Silicon Valley).

Per data from PitchBook, a further 8.1% of the VC spending pot went to other parts of Silicon Valley, such as Santa Clara and San Jose.

Coming in behind San Francisco was—perhaps unsurprisingly—New York, which swiped 14.4% of the VC funding across those three years.

This dynamism correlates with the bedrock of talent available to both metropolitans, which have a handful of America’s top universities on their doorsteps.

This…

Click Here to Read the Full Original Article at Fortune | FORTUNE…