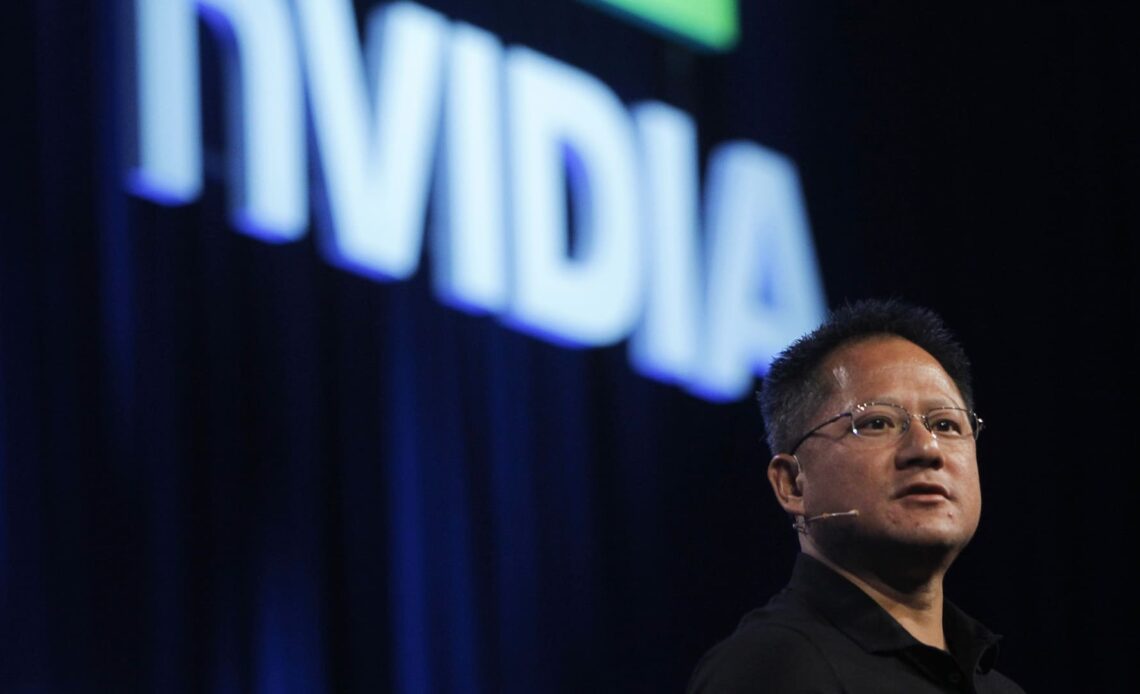

Here are Thursday’s biggest calls on Wall Street: Citi upgrades Prime to buy from neutral Citi said the gene editing company has a “favorable” risk/reward outlook. ” Prime currently has cash runway into 2H25, and mgmt. is conscious of appropriately managing burn.” Piper Sandler reiterates Nvidia as overweight Piper said it’s sticking with its overweight rating heading into earnings on May 22. “Overall, NVDA remains our top large-cap pick and we remain bullish that the Blackwell series will provide meaningful acceleration to revenues longer-term.” JPMorgan reiterates Netflix as overweight JPMorgan said it’s sticking with its overweight rating following Netflix’s upfront advertising presentation. “We remain positive on NFLX following the formal announcement for rights to Xmas Day NFL games and the 2024 Upfront presentation announcements, & we expect to learn more after spending time with the company [today].” Wolfe upgrades Intel to peer perform from underperform Wolfe said in its upgrade of Intel that its bear thesis had played out. “With sentiment and expectations lower, we upgrade to PP, but we still don’t see enough earnings power to support a favorable rating.” Piper Sandler upgrades Quaker Houghton to overweight from neutral Piper said it’s bullish on shares of the specialty chemical company. “We are initiating coverage of KWR with an OW rating and a PT of $220. While near term growth is dampened by the macro environment, the company has multiple levers to enhance upside.” Truist upgrades Coterra Energy to buy from hold Truist said it sees a “solid shareholder return story” for the energy company. “We forecast Coterra is on pace to potentially generate $2.5B+ FCF in 2025 setting up a solid shareholder return story even while recently slowing natural gas activity given relatively weak current prices.” JPMorgan reiterates Palo Alto Networks as overweight JPMorgan raised its price target to $340 per share from $330 ahead of earnings on May 20. “We remain Overweight rated as we continue to view PANW well positioned within our coverage to consolidate share within several of the largest and highest priority enterprise security markets. Our price target moves to $340, reflecting channel commentary and recent multiple appreciation.” JMP reiterates Robinhood as market outperform JMP said it’s sticking with its market outperform rating on the stock trading company. “Flash forward to today, Robinhood still represents the closest proxy in the public markets…

Click Here to Read the Full Original Article at Investing…