Disney returned to a profitable third quarter as its combined streaming business started making money for the first time, along with a very strong showing in theaters for the movie “Inside Out 2.”

Operating income for the entertainment segment, which includes its movie studio and parts of its television wing, nearly tripled to $1.2 billion. Disney’s run at the box office continues with “Deadpool & Wolverine,” giving the company the top two films of the year.

The Walt Disney Co. said Wednesday that its direct-to-consumer business, which includes Disney+ and Hulu, reported a quarterly operating loss of $19 million, which was much smaller than its loss of $505 million a year earlier. Revenue climbed 15% to $5.81 billion.

The results were announced a day after Disney said that it will be boosting prices for Disney+, Hulu and ESPN+, starting on Oct. 17. Disney+ and Hulu will each cost $9.99 a month with ads, a $2 increase for each plan. The ad-free version of Disney+ will run $15.99 monthly, a $2 uptick, while Hulu will be $1 more, at $18.99 monthly for the ad-free version. ESPN+, which is only available with ads, will have a monthly cost of $11.99, a $1 increase.

Disney earned $2.62 billion, or $1.43 per share for the period ended June 29. A year earlier it lost $460 million, or 25 cents per share.

Stripping out one-time gains, earnings were $1.39 per share, easily topping the $1.20 analysts polled by Zacks Investment Research expected.

Revenue for the Burbank, California, company rose 4% to $23.16 billion, beating Wall Street’s estimate of $22.91 billion.

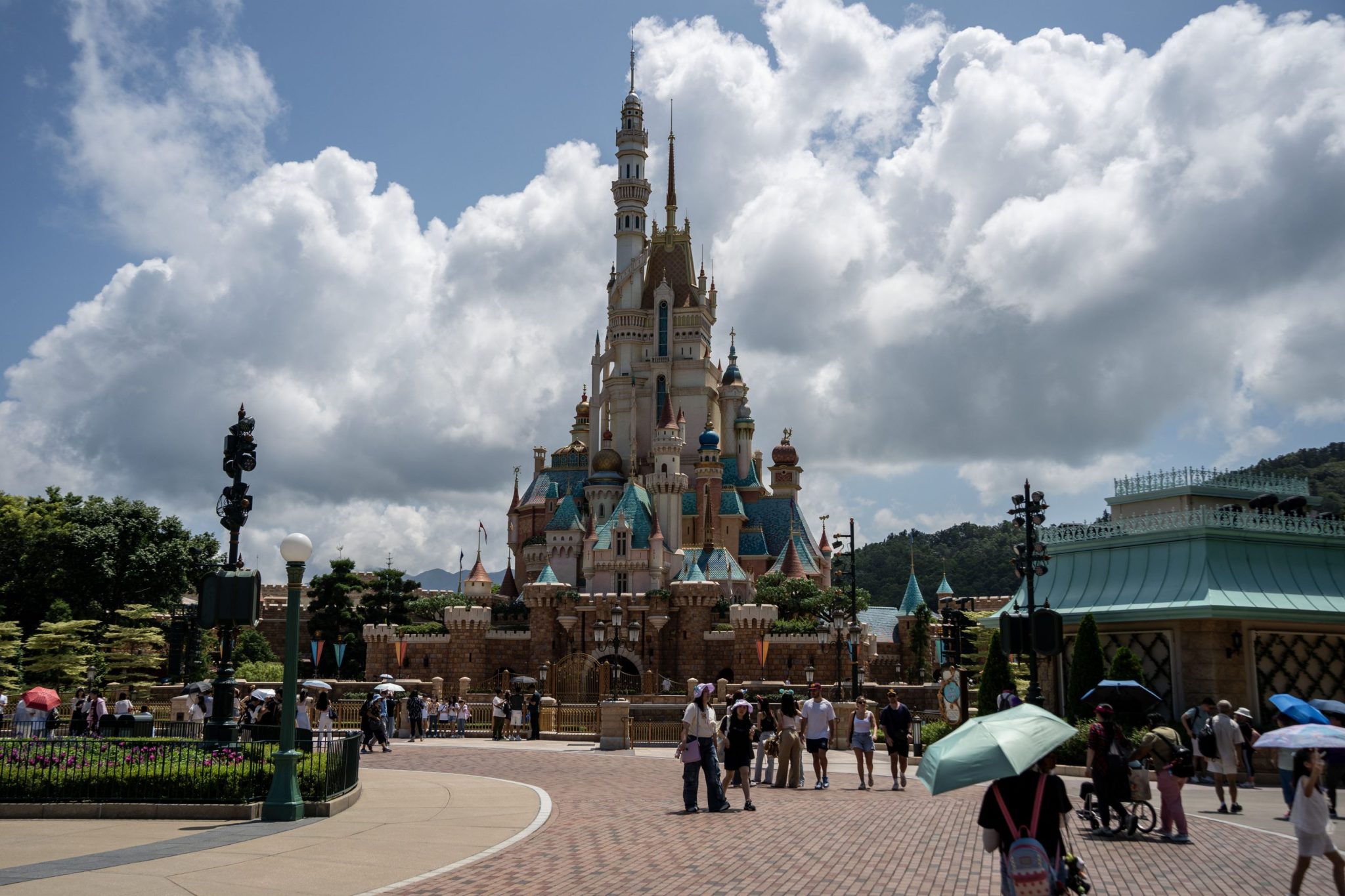

Theme parks aren’t so hot

Disney’s stock was pressured in early trading with some weakness showing in domestic parks, part of its Experiences division that includes six global theme parks, its cruise line, merchandise and videogame licensing. The company cautioned that the moderation in demand it saw at U.S. parks could linger for the next few quarters.

It anticipates fourth-quarter Experiences operating income falling by mid single digits compared with the prior-year period due to the domestic parks moderation as well as cyclical softening in China and less people at Disneyland Paris due to the impact the Olympics had on normal consumer travel.

Johnston said during the company’s conference call that the parks have been impacted by lower-income consumers feeling more financial stress, while higher-end consumers are doing a bit more international travel now….

Click Here to Read the Full Original Article at Fortune | FORTUNE…