Super Micro’s stock lost nearly a fifth of its value on Wednesday in another dark day for the once high-flying AI darling. The drop came after the server hardware company delayed the submission of its annual financial report for the fiscal year 2024, often a red flag for investors that there could be significant financial, accounting, or legal issues at a company.

Super Micro management told shareholders it needs time to complete an assessment of the internal controls of its financial reporting.

A representative confirmed to Fortune that Super Micro will not file its annual report for fiscal year 2024 within “the prescribed time period,” but didn’t offer any indication as to when the report will be filed. “Additional time is needed to assess some internal controls,” the representative said, echoing the company’s public statements.

The filing delay comes after Super Micro was hit with accusations of accounting manipulation and sanctions evasion by the activist short seller Hindenburg Research on Tuesday.

In a 19,000 word short report, Hindenburg Research said it found “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures,” and more. The short seller and research company conducted a three-month investigation into Supermicro that included interviews with insiders, industry experts, and a review of accounting and litigation records. The controversial firm is named after the famed airship disaster, and targets companies it believes are headed for a dramatic fall. Hindenburg’s posts often trigger major stock price drops, or legal and regulatory investigations.

“The Company does not comment on rumors and speculation,” a representative for Super Micro told Fortune when asked about the short report.

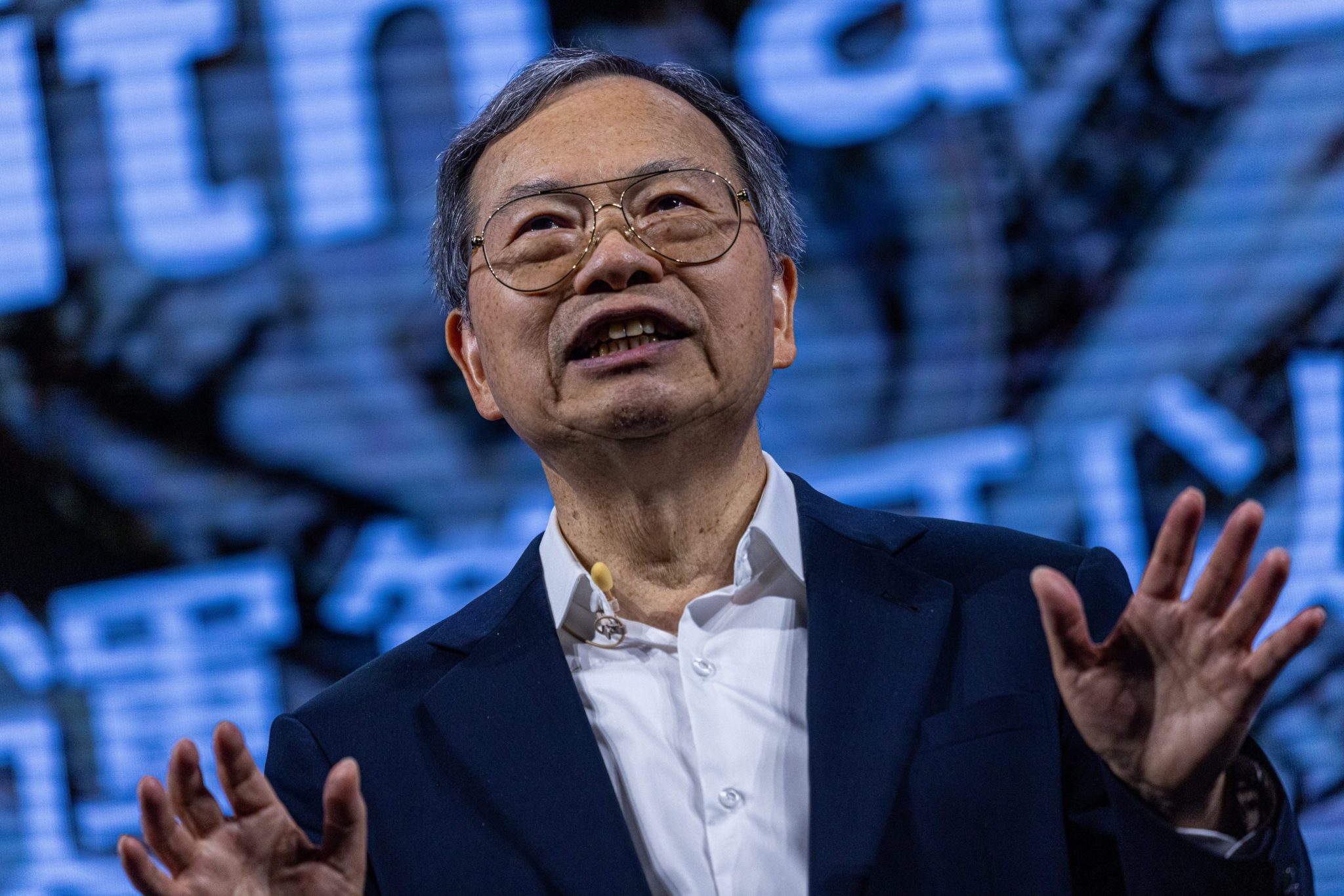

Super Micro provides servers, networking equipment, storage systems, and other critical components and solutions for data centers. With the AI boom in full-swing in recent years, demand for its products has exploded. The company, which was founded by Charles Liang in 1993, was added to the Fortune 500 for the first time this year after its annual fiscal revenue hit a record $7.12 billion.

Investors were quick to notice Super Micro’s AI opportunity over the past few years. Its stock soared 6368% from around $19 per share in August 2019 to its intraday peak of $1,229 on March 8 of this year. Just 10 days later, the company was added to the S&P 500 Index in…

Click Here to Read the Full Original Article at Fortune | FORTUNE…