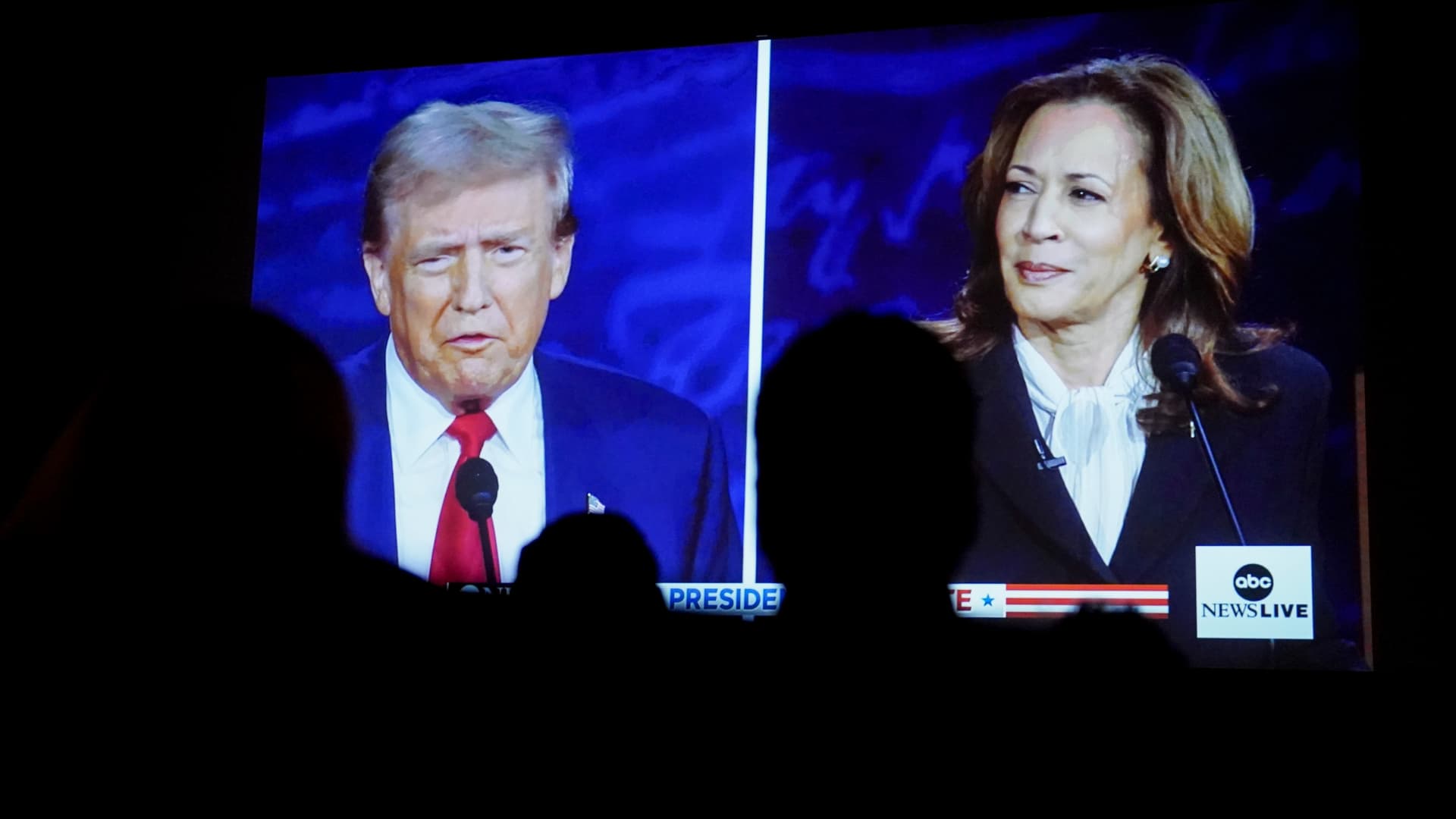

The outcome of November’s presidential election could have major implications for some popular technology stocks. Ahead of the high-stakes race, Raymond James laid out a list of some key technology, media and telecommunications stocks that could benefit in a variety of different outcomes. In 2020, the firm’s picks outperformed the S & P 500 by 1% between the election and inauguration — and 7.7% in the year that followed. Broadly speaking, Raymond James views a Donald Trump reelection as a potential boon for the industry and artificial intelligence — with heightened export controls in the semiconductor industry. It could also lead to increased tensions in China and the obstruction of mergers and acquisitions activity across borders. “The deregulatory focus of a second Trump administration would likely see less federal oversight and the potential rollback of reporting requirements for AI firms developing frontier models, while also supporting data center development through nuclear energy permitting,” wrote Ed Mills, the firm’s Washington policy analyst. Meanwhile, a victory by Vice President Kamala Harris victory may lead to tighter AI regulations focused on safety, ethics and protecting consumers. Mills also anticipates more focus on supporting domestic semiconductor production. Democrat sweep A Harris presidency and a Democrat-led Congress could be a boon for companies with exposure to climate regulation and “high margin vertical” software companies with less cyclical exposure. That includes cloud solutions provider Veeva Systems . Jabil and Flex should also benefit in this scenario, with analyst Melissa Fairbanks noting that a Harris win would incentivize solar and renewable energy. Shares of Jabil have slumped about 10% this year, while Flex has outperformed the market and gained more than 44%. Visa is another potential winner in a Democratic sweep that poised to benefit from the likelihood of a higher corporate tax rate, according to analyst John Davis. “A Democratic sweep would likely enhance regulatory scrutiny across banks and large cap technology, which historically has results in outperformance by large cap fintech as these stocks tend to be hiding places for both tech and financial portfolio managers,” he wrote. Split scenarios Raymond James views some companies as beneficiaries even in a split government outcome. For Democrats, that would mean Harris as president, a split House and a Republican Senate. In a split government under Trump,…

Click Here to Read the Full Original Article at Investing…