A trader wears a Trump hat as he works on the floor of the New York Stock Exchange during the opening bell on Nov. 6, 2024.

Timothy A. Clary | Afp | Getty Images

On Nov. 5, the presidential election handed a decisive victory for President-elect Donald Trump. In the days that followed, the markets soared.

A “Trump trade” led to new index highs for the S&P 500 and Dow Jones Industrial Average, lifted with the help of certain sectors expected to do well under the president-elect’s second term.

As of Monday, the postelection market fervor had started to subside to preelection levels.

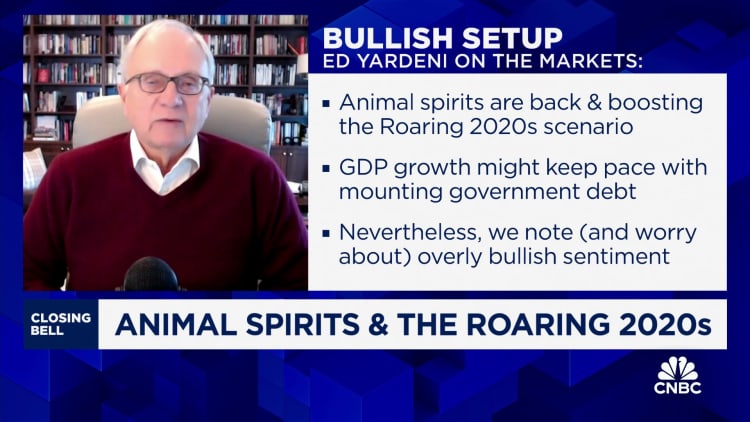

Yet, some experts say they are seeing a renewal of so-called animal spirits.

“Animal spirits” is a term first coined by economist John Maynard Keynes and refers to the tendency for human emotion to drive investment gains and losses.

Some experts say animal spirits are a sign of consumer confidence. However, the phenomenon can also be trouble for investors if they take on “excessive risk,” said Brad Klontz, a psychologist and certified financial planner.

“It’s essentially why dead investors outperform living investors, because dead investors are not impacted by their animal spirits,” Klontz said.

Research has shown dead investors’ portfolios tend to outperform, since they are left untouched because they are less likely to be influenced by emotional decisions, such as panic selling or buying.

Investors may be excited or fearful

The recent market runup was not prompted by individual investors chasing the market to a meaningful extent, according to Scott Wren, senior global market strategist at Wells Fargo. Individuals, who were split in their election choices, are also divided in their investment outlook, he said.

“Depending on who your candidate was, you may be excited about the future or fearing the future,” Wren said.

Instead, it has been professional traders and money managers — who couldn’t sit on cash when the S&P 500 index was setting new records every two or three days — who have helped drive the markets higher, he said.

There is also big-picture excitement going into 2025, according to Wren, with expectations for lower taxes, less regulation and reasonable levels of inflation. However, the U.S. economy might have a couple of quarters of slower growth in 2025, he said.

“We’re not going to have a recession,” Wren said. “We think that’s very unlikely.”

‘Nobody is immune’ to investing missteps

Ideally, investors ought to sell stocks when they are priced high and buy when they are low.

But…

Click Here to Read the Full Original Article at Top News and Analysis (pro)…