The world’s hottest company is back to wrap up tech earnings season as money managers are waiting nervously as Nvidia gets set to reveal its latest quarterly results on Wednesday afternoon. While Wall Street is expecting another strong showing for Q3—Visible Alpha predicts revenue will increase 84% year-over-year to $33.2 billion—all eyes are on the chip giant’s forecast for the final quarter of the year.

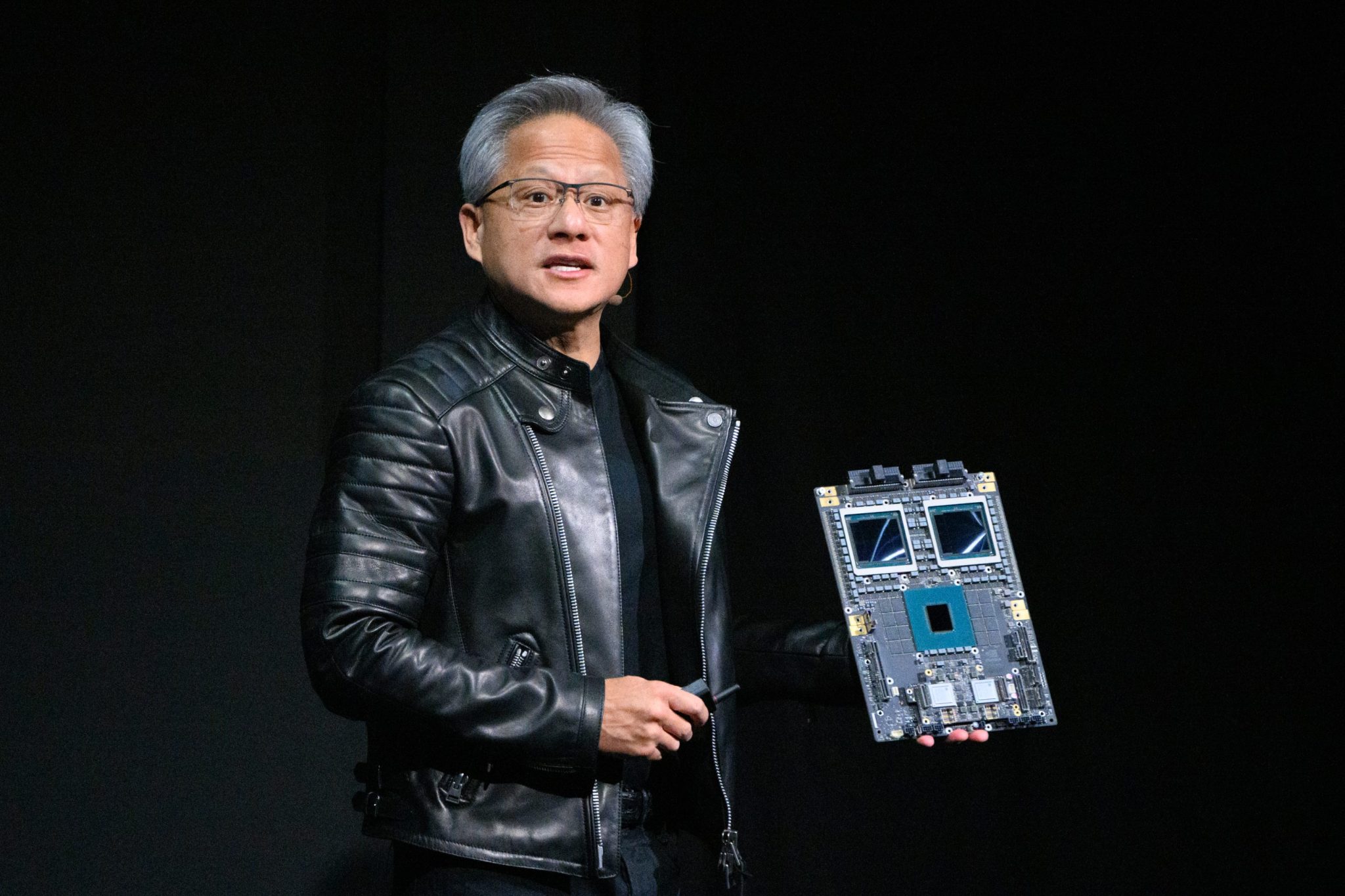

That’s because the company’s next-generation GPU offering, or Blackwell, is scheduled to start hitting the bottom line. CEO Jensen Huang has touted “insane” demand for the new platform, which represents a dramatic step up in performance from the so-called “Hopper” chips that have fueled the AI boom. It’s a dramatic show of innovation and strength from a company that has seen its shares skyrocket more than 800% over the last two years, with the company adding more than $3 trillion in market cap to trade places with Apple as the world’s largest company.

Wedbush Securities’ Dan Ives, one of Wall Street’s most prominent tech bulls, is anticipating another blowout release, saying that a $2 billion revenue beat and similar raise to Q4 guidance will signal that the AI party is just getting started.

“We expect another jaw dropper tomorrow from the Godfather of AI Jensen that will put jet fuel in this bull market engine,” Ives and other Wedbush analysts wrote in a note.

Others who follow the stock, however, are sound more cautious note. Multiple analysts told Fortune Wednesday’s call could prove to be a “sell the news” event. That’s what happened last quarter, even though the company comfortably beat earnings and revenue expectations as sales grew over 122% year-over-year.

The stock dropped 18% in the week following the call, trading just north of the $100 mark, as investors pocketed their gains. The stock has gained roughly 40% since, however. Shares rose about 4% Tuesday, moving above the $145 threshold, in anticipation of another blowout release.

Nonetheless, the stage may be set for another round of immense profit taking, according to Ted Mortonson, a managing director and technology desk sector strategist at Baird. Retail investors, he said, often trade on “FOMO,” or the fear of missing out. By contrast, he added, institutions will likely be driven by what he dubbed “FOGK.”

“That’s fear of getting killed,” he said.

With the stock nearly tripling year-to-date, he explained, his…

Click Here to Read the Full Original Article at Fortune | FORTUNE…