Westend61 | Westend61 | Getty Images

The end of the year is one of the most important times for investors because there are so many decisions to make that impact their overall financial planning.

This time around, the year’s end is marked with a lot of financial challenges, including inflation, market volatility, domestic political uncertainties and global geopolitical risks and issues. To help you navigate these complicated financial times, here’s a checklist to review and implement as applicable:

Shelter money from taxes

Max out your retirement plan contributions to your employer’s 401(k) plan by Dec. 31. Try to increase your 401(k) contribution so that you are putting in the maximum amount of money allowed. And be sure to take advantage of any employer match.

Workers who are younger than age 50 can contribute up to $20,500 to a 401(k) this year. If you’re at least age 50, you can add an extra $6,500 per year in “catch-up” contributions. Self-employed people also can contribute to a SEP-IRA, Simple or one-person 401(k).

Talk to your financial pro about also setting up an individual retirement account. And don’t forget that making deductible contributions to a registered non-profit is a great way to reduce your taxable income.

Review tax-loss harvesting

Speaking of taxes, what about those gains in your account that you’d like to realize, but prefer not to pay capital gains on? Do you also have investments in your brokerage account that are no longer serving you and trading in the red?

Tax-loss harvesting is a strategy used to sell selected investments in your portfolio at a loss in order to offset the negative tax impact from other investments sold at a profit. This can reduce taxes on the capital gains.

Speak with your financial advisor to request a 2022 gains/loss statement before year-end to review your options.

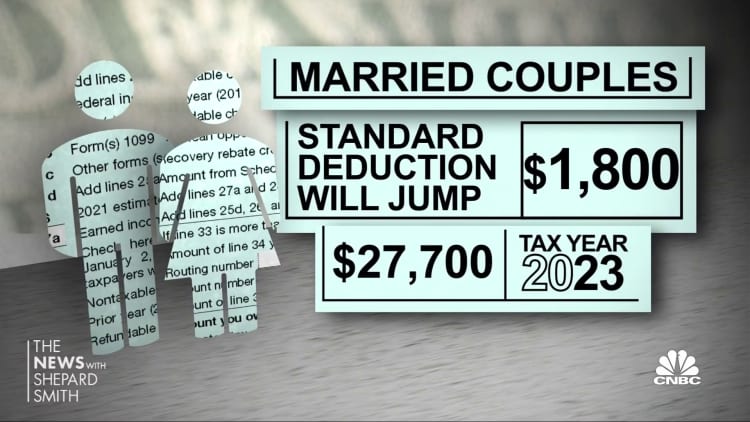

Determine if the standard deduction is right for you…

It’s a smart move to get ahead for tax season. The standard deduction for married couples filing jointly for tax year 2022 is $25,900, up $800 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction is $12,950 for 2022, up $400, and for heads of households, the standard deduction is $19,400 for tax year 2022, up $600.

… or whether itemizing is better

According to the IRS, about 75% of taxpayers take the standard deduction but…

Click Here to Read the Full Original Article at Top News and Analysis (pro)…