EPAM Systems (NYSE:EPAM) delivered better-than-expected results for the first quarter. However, EPAM stock was down about 27% in yesterday’s trading session. The share price decline comes after the company lowered its full-year 2024 revenue and adjusted earnings guidance due to slower-than-anticipated demand growth.

EPAM is a global provider of digital platform engineering and software development services.

EPAM Q1 Highlights

The company posted earnings of $2.46 per share, beating consensus estimates of $2.31. However, the reported figure declined by 0.4% from the prior-year quarter.

Meanwhile, Q1 revenues of $1.17 billion fell by 3.8% year-over-year but surpassed the Street’s estimates of $1.16 billion. The year-over-year decrease can be attributed to lower income from several business offerings, including retail, financial services, software and hi-tech, and business information and media.

Q2 and Full-Year 2024 Outlook

The company expects its full-year revenues to be between $4.575 billion and $4.675 billion, reflecting a year-over-year decline of 1.4% at the midpoint of the range and below analysts’ forecasts of $4.81 billion. Previously, the company had guided revenue to be in the range of $4.74 billion to $4.88 billion.

Also, EPAM narrowed its 2024 adjusted EPS guidance to between $10 and $10.30 per share from $10 to $10.40. At the same time, analysts are forecasting EPS of $10.17 per share.

For the second quarter, EPAM expects revenues to be in the range of $1.135 billion to $1.145 billion and adjusted EPS to be between $2.21 and $2.29.

Is EPAM Stock a Good Buy?

Overall, the stock has a Moderate Buy consensus rating based on 10 Buy, six Hold, and one Sell recommendations. After a 37% drop in its share price over the past three months, analysts’ average price target on EPAM stock of $308.44 implies an upside potential of 70% from current levels.

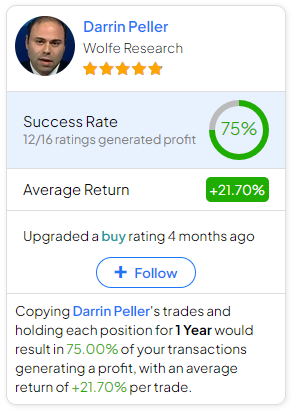

Interestingly, investors interested in EPAM stock could consider following Wolfe Research analyst Darrin Peller. He is the most accurate and profitable analyst covering the stock (in a one-year timeframe). He boasts an average return of 21.7% per rating and a 75% success rate. Click on the image below to learn more.

Click Here to Read the Full Original Article at TipRanks Financial Blog…