Telecom giants T-Mobile US (NASDAQ:TMUS) and Verizon Communications (NYSE:VZ) are reportedly eying to acquire spectrum holdings from United States Cellular Corporation (NYSE:USM), a regional wireless carrier. The companies are currently engaged in negotiations with USM under a split-sale arrangement, the Wall Street Journal reported. These discussions involve separate transactions aimed at granting both T-Mobile and Verizon access to valuable wireless frequencies.

Per the report, T-Mobile is close to acquiring a part of USM, which will include USM’s wireless spectrum licenses, for over $2 billion. The potential deal with T-Mobile may be finalized as early as this month. On the other hand, discussions with Verizon regarding a separate arrangement could take more time or may not materialize.

The split-sale structure will likely make regulatory approval easier.

The Rationale Behind the Deal

Verizon and T-Mobile are both considering acquisitions as they seek growth opportunities. It’s worth noting that the lack of a new spectrum auction has driven up the value of wireless licenses. Thus, these companies are taking the acquisition route to leverage USM’s spectrum licenses.

United States Cellular Corporation holds wireless spectrum licenses directly or through investments in parts of 30 states, covering a total population of approximately 51 million as of December 31, 2023. USM, which is majorly owned by Telephone and Data Systems (NYSE:TDS), is exploring a range of strategic alternatives to boost shareholder value.

Is T-Mobile a Good Stock to Buy?

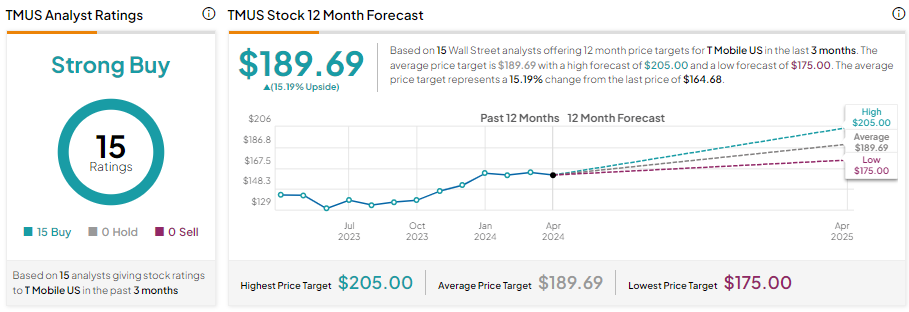

T-Mobile stock is up about 17% in one year and sports a Strong Buy consensus rating based on 15 unanimous Buy recommendations from Wall Street analysts. These analysts’ average price target on TMUS stock is 189.69, implying 15.19% upside potential from current levels.

Is Verizon a Buy or Sell?

Verizon stock is up about 14% in one year. Wall Street analysts are cautiously optimistic about VZ’s prospects. With three Buy and seven Hold recommendations, Verizon stock has a Moderate Buy consensus rating.

Analysts’ average price target on VZ stock is 43.20, implying 8.57% upside potential from current levels.

Click Here to Read the Full Original Article at TipRanks Financial Blog…