The most popular example of the fecklessness of Silicon Valley Bank is that it stupidly amassed a $124bn bond portfolio and then — even more madly — didn’t hedge against the swelling interest rate exposure.

But is that right? FT Alphaville dug into the balance sheets of SVB and Credit Suisse for an incredibly sad geeky compare-and-contrast. The tl;dr is perhaps not quite as idiotic as a lot of people assume, but pretty dumb. Be warned, the following is acronym-heavy.

The first thing to remember is that SVB’s bond portfolio was basically in two different accounting buckets. At the end of 2022 it held $91.3bn in a “held-to-maturity” portfolio — bonds you plan to hold on to until they are repaid — and $26.1bn in an “available-for-sale” portfolio, which is marked to market.

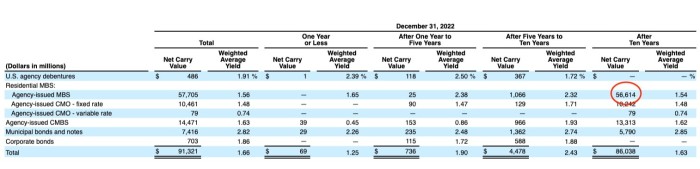

Here’s a snapshot from SVB’s end-of-2022 financial accounts.

Let’s take the chunkier HTM portfolio first. Securities in the HTM basket can be carried at their nominal par value, because the assumption is that they are being held until they’re repaid in full.

As the table below shows, most of SVB’s $91.3bn HTM portfolio consisted of very-long-term, agency-guaranteed, mortgage-backed securities maturing in 10 years or more ($56.6bn to be exact).

The creditworthiness of this stuff is extremely high, but it’s also very sensitive to interest rates (for bond nerds, the average duration of the HTM portfolio was 6.2 years).

Because of rising rates the actual market value of the HTM portfolio was about $76bn at the end of 2022, according to someone who has seen the details of the portfolio and shared them with FTAV — an unrealised loss of $15.1bn.

Yes, SVB didn’t have any hedges on this bit. But doing so would arguably be nonsensical. Remember, the entire HTM portfolio is held at par, but the value of the hedge would obviously fluctuate with the market.

So if rates rise then a bank makes money on the hedge, but the bonds stay at par. If rates fall then they lose money on the hedge, but they can shift bonds from HTM to AfS and sell them at the higher price. That means it basically becomes a directional bet on interest rates that flows straight into the income statement, something that most banks abhor.

For example, Credit Suisse’s HTM portfolio of Treasuries maturing in 1-5 years stood at a pretty minimal $992mn at the end of 2022. The market value was about $949mn, but there doesn’t seem to be any hedge on here either despite the unrealised loss.

FTAV…

Click Here to Read the Full Original Article at UK homepage…